Get Tx Tad 1320 - Tarrant County 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX TAD 1320 - Tarrant County online

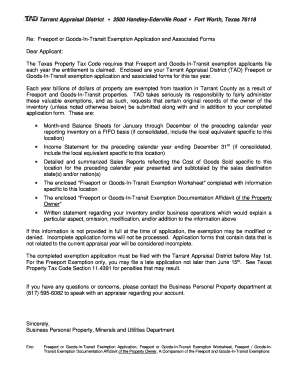

Filling out the TX TAD 1320 form for the Freeport or Goods-In-Transit exemption can be an essential step for individuals and businesses seeking property tax relief in Tarrant County. This guide will walk you through each section of the form, ensuring you have the information needed to complete it accurately and efficiently.

Follow the steps to successfully complete the TX TAD 1320 form online.

- Click ‘Get Form’ button to access the TX TAD 1320 form and open it in your preferred online tool.

- Begin by entering the owner's name and current mailing address, including the street address, city, state, and ZIP code. Identify who is preparing the form by including their name as well.

- Provide your appraisal district account number. If available, attach a tax bill or correspondence regarding this account. Describe the location of the inventory with the appropriate address details.

- Answer the questions about the inventory. Indicate whether portions of the inventory will be transported out of state this year. Provide the total cost of goods sold for the previous calendar year and the cost of those goods shipped out of Texas within 175 days.

- Document the types of records on which you base the amounts provided and the percentage of last year's inventory represented by Freeport goods. If the percentage will differ this year, explain why.

- Complete the market value of the inventory on January 1 and specify the value you claim will be exempt this year. Ensure all signatures are included where needed.

- Review all sections for completeness and accuracy. Attach any additional documents requested and verify that they conform to the requirements outlined. You must file this completed form before May 1 or by June 15 for a late application.

Start completing your TX TAD 1320 form online today to ensure you receive the exemptions you deserve.

Yes, property taxes can freeze at age 65 in Texas for seniors. Once you file and meet the criteria set by the local appraisal district, your property tax amount is locked in, helping you manage your finances more effectively. To navigate this process smoothly, consider using resources such as the TX TAD 1320 - Tarrant County to ensure you get all necessary information and assistance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.