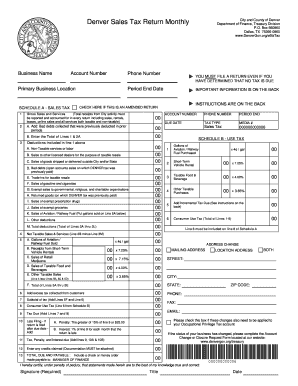

Get Tx Sales Tax Return Monthly Form - Denver City & County

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign TX Sales Tax Return Monthly Form - Denver City & County online

How to fill out and sign TX Sales Tax Return Monthly Form - Denver City & County online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Completing tax forms can turn into a major challenge and significant nuisance if adequate help is not provided. US Legal Forms has been established as an online solution for TX Sales Tax Return Monthly Form - Denver City & County electronic filing and presents various benefits for taxpayers.

Utilize the guidance on how to complete the TX Sales Tax Return Monthly Form - Denver City & County:

Click the Done button in the upper menu once you have completed it. Save, download, or export the finished form. Utilize US Legal Forms to ensure an easy and straightforward completion of the TX Sales Tax Return Monthly Form - Denver City & County.

- Obtain the blank form from the website in the specified section or through the search engine.

- Press the orange button to access it and wait until it is completed.

- Review the template and follow the instructions. If you have never filled out the template before, follow the line-by-line directives.

- Pay attention to the highlighted fields. They are editable and require specific information to be inputted. If you are uncertain about what information to include, refer to the instructions.

- Always sign the TX Sales Tax Return Monthly Form - Denver City & County. Use the integrated tool to create the e-signature.

- Click on the date field to automatically insert the correct date.

- Review the form to click and modify it before submitting.

How to modify Get TX Sales Tax Return Monthly Form - Denver City & County: tailor forms online

Place the correct document alteration tools at your disposal. Complete Get TX Sales Tax Return Monthly Form - Denver City & County with our trustworthy solution that includes editing and eSignature capabilities.

If you wish to execute and validate Get TX Sales Tax Return Monthly Form - Denver City & County online without hassle, then our online cloud-enabled option is the perfect resolution. We offer a rich template-based library of ready-to-use documents you can modify and finish online. Additionally, you won't need to print the document or rely on external tools to make it fillable. All the essential features will be accessible for your use as soon as you access the file in the editor.

Let’s explore our online editing tools and their primary functionalities. The editor boasts an intuitive interface, ensuring you won’t require much time to learn how to operate it. We’ll look into three main components that allow you to:

In addition to the functionalities listed above, you can secure your file with a password, incorporate a watermark, convert the document to the desired format, and much more.

Our editor simplifies the process of completing and certifying the Get TX Sales Tax Return Monthly Form - Denver City & County. It enables you to do nearly everything regarding document management. Furthermore, we always ensure that your document editing experience is safe and complies with the leading regulatory standards. All these features enhance the enjoyment of using our tool.

Obtain Get TX Sales Tax Return Monthly Form - Denver City & County, implement the necessary edits and modifications, and download it in your preferred file format. Give it a go today!

- Revise and annotate the template

- The top toolbar is equipped with features that assist you in highlighting and obscuring text, excluding images and visual elements (lines, arrows, checkmarks, etc.), signing, initializing, dating the document, and more.

- Arrange your documents

- Utilize the left toolbar if you wish to rearrange the document or remove pages.

- Prepare them for distribution

- If you aim to make the template fillable for others and distribute it, you can leverage the tools on the right to insert various fillable fields, signatures, dates, text boxes, etc.

Texas sales tax returns are generally due based on the frequency assigned to your business. Monthly filers must submit their returns by the 20th of each month. Quarterly and annual filers have different due dates, which you should confirm based on your classification. Be sure to review your deadlines regularly to ensure timely submissions on your TX Sales Tax Return Monthly Form - Denver City & County.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.