Get Tx Comptroller Ap-197 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller AP-197 online

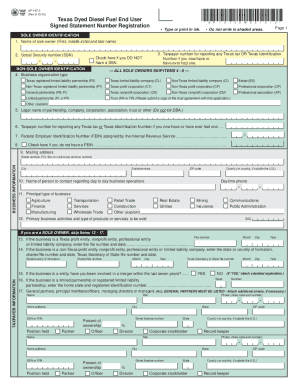

Filling out the TX Comptroller AP-197 form is an important step for individuals and organizations seeking to purchase tax-free dyed diesel fuel for off-highway use in Texas. This guide will walk you through the online completion of this form, ensuring that you provide all necessary information accurately and efficiently.

Follow the steps to complete the TX Comptroller AP-197 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify your status as a sole owner or an organization. Sole owners will fill out item 1 and skip to item 19, while organizations will complete sections 4 through 8.

- For item 1, if you are a sole owner, enter your first name, middle initial, and last name. For item 4, specify the type of organization by checking the appropriate box.

- In item 5, provide the legal name of your organization as registered. If applicable, proceed to items 6 and 7 for your Texas taxpayer number and Federal Employer Identification Number.

- For item 9, enter the mailing address where you wish to receive correspondence from the Comptroller's office.

- Complete items 13 to 17 if applicable to your organization, providing relevant details about your formation and background.

- In item 19, describe the business location in detail, ensuring not to use a P.O. Box or rural route number to maintain accuracy.

- Select the appropriate use type for the dyed diesel fuel in item 20, checking either ‘AG’ for agricultural use or ‘DD’ for non-agricultural purposes.

- Proceed to answer questions 21 to 23 regarding diesel-powered vehicles, bulk storage, and off-highway use.

- Ensure that all necessary parties sign the form in item 24, confirming all provided information is accurate and complete.

- Finally, save your changes, download a copy, print the form, or share it as needed for submission.

Complete the TX Comptroller AP-197 online today for smooth processing of your tax-free dyed diesel fuel purchases.

Get form

To complete a sales and use tax certificate of exemption, you should obtain the correct form from the Texas Comptroller. Fill in your organization’s details, including the Texas sales tax permit number if applicable. Clearly indicate the specific items or services you’re claiming exemption for, and make sure to retain a copy for your records. Utilize uslegalforms to find the right templates and streamline this process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.