Get Tx Comptroller Ap-114 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

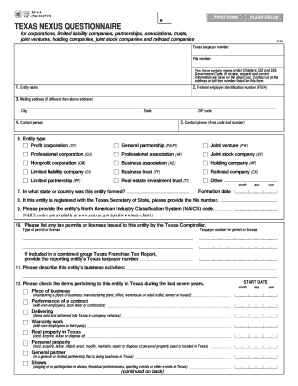

How to fill out the TX Comptroller AP-114 online

The TX Comptroller AP-114 is a vital document used for filing various claims and transactions related to Texas state taxation. This guide aims to provide you with a straightforward, step-by-step process to complete the form online, ensuring you have all the necessary information at hand.

Follow the steps to complete the TX Comptroller AP-114 online

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Review the form's instructions at the top. Familiarize yourself with the requirements and necessary information to ensure accurate completion.

- Fill in your name and address in the appropriate fields. Make sure to provide the correct information as it is essential for processing.

- In the next section, indicate the type of claim you are filing by selecting the relevant option from the list provided.

- Complete the details requested in each subsequent field. This may include financial data, descriptions of the items, or additional documentation requirements.

- Once all sections of the form have been accurately completed, review your responses for any errors or missing information.

- After verifying the form, you can save your changes, download a copy, print it, or share it as needed.

Take the first step toward completing your TX Comptroller AP-114 online today!

Get form

If you fail to file franchise tax in Texas, you may face penalties and interest charges, which can substantially increase your tax liability. Additionally, the Texas Comptroller may revoke your company’s ability to do business in the state. To avoid these consequences, ensure that you are familiar with the filing process, including using the TX Comptroller AP-114 for any needed adjustments.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.