Loading

Get Tx Comptroller 69-126 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 69-126 online

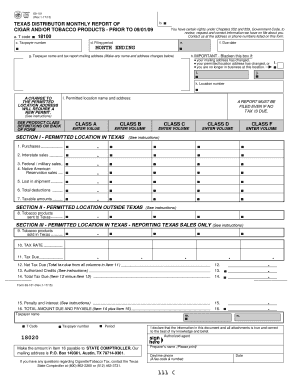

Filling out the TX Comptroller 69-126 form online can streamline the reporting process for distributors of tobacco products. This guide provides comprehensive instructions on how to complete each section of the form accurately and effectively.

Follow the steps to complete the TX Comptroller 69-126 form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering your 11-digit taxpayer identification number and the appropriate filing period at the top of the form.

- In the section for taxpayer information, fill in your name and mailing address. Be sure to blacken the box if there have been any changes to your mailing address or business location.

- Proceed to Section I - Permitted Location in Texas, and complete the respective fields for Classes A through F by entering the value and volume for each category of tobacco products sold.

- Move to Section II to report any tobacco products sent to Texas from locations outside the state, ensuring to enter data for each product class accordingly.

- In Section III, denote the amounts of tobacco products sold in Texas, entering the relevant information for each product class.

- Calculate tax due based on the reported amounts, entering figures in the designated fields, including any authorized credits for the filing period.

- Finally, review all provided information for accuracy. You can save your changes, download, print, or share the form as needed.

Complete your TX Comptroller 69-126 form online today to ensure timely filing and compliance.

Claiming compensation from the Texas Comptroller typically involves submitting a formal request through their designated processes. You may need to provide documentation related to your claim and follow the guidelines specified for compensation under TX Comptroller 69-126. For help with forms or understanding your rights, consider using the resources available on uslegalforms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.