Loading

Get Tx Comptroller 50-767 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 50-767 online

This guide provides a clear and supportive framework for users to complete the TX Comptroller 50-767 form online. By following these steps, you will ensure accurate and comprehensive submission of your property tax information.

Follow the steps to complete the form effectively.

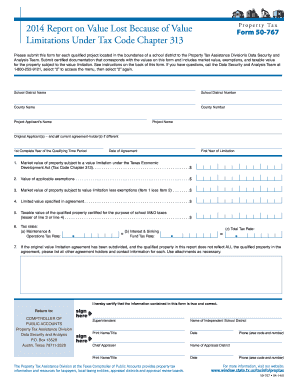

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Identify the school district by entering the school district name and number in the appropriate fields. Ensure this information is accurate to facilitate proper processing.

- Enter the county name and corresponding county number to provide context for the property location. This step is essential to link the property accurately to governmental records.

- Fill in the project applicant's name and project name. This identifies who is responsible for the project and its title.

- If the original applicant(s) differ from current agreement holders, list all names in the provided space. Keep this section clear to avoid confusion.

- Move to section 1, where you will report the market value of the property subject to a value limitation under the Texas Economic Development Act (Tax Code Chapter 313). Ensure accuracy as this affects taxation calculations.

- In section 2, document the value of any applicable exemptions such as pollution control or other relevant exemptions. This detail is crucial for accurate tax computations.

- Calculate the market value less exemptions by subtracting the value from step 2 from the value in step 1 and enter the result in section 3.

- Report the limited value as specified in your agreement in section 4. This reflects the ceiling on property taxes.

- Calculate and enter the taxable value in section 5. This should be the lesser of the market value less exemptions (step 3) or the limited value (step 4).

- Provide the tax rates in section 6 by entering the maintenance & operations tax rate and the interest & sinking fund tax rate. Sum these to obtain the total tax rate.

- If applicable, complete section 7 by listing any other agreement holders and their contact information if the original agreement has been subdivided. Use additional attachments as necessary.

- Once all fields are completed accurately, ensure to sign the document. The Superintendent and the Chief Appraiser must sign the form to validate the information provided.

- Finally, save your changes, download, print, or share the filled-out form as needed.

Complete your documents online confidently and efficiently.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Your Texas tax account number can be found on any tax documents or correspondence from the Texas Comptroller. Alternatively, you can log into your account on their website for easy access. If you still have trouble locating it, contacting the Comptroller's office directly will provide you with the help you need.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.