Loading

Get Tx Comptroller 50-765 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 50-765 online

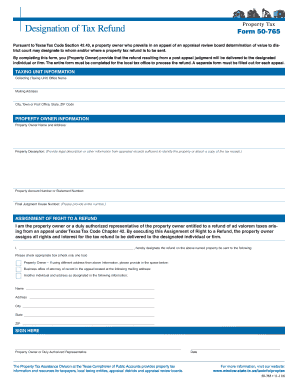

The TX Comptroller 50-765 form, known as the Designation of Tax Refund, allows property owners to designate where a property tax refund should be sent following a successful appeal. This guide provides step-by-step instructions for completing the form online, ensuring a smooth filing process.

Follow the steps to complete the 50-765 form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill out the Taxing Unit Information section. This includes providing the name of the collecting office and the appropriate mailing address, including city, state, and ZIP code.

- Complete the Property Owner Information section. Provide your name and mailing address, along with the legal description of the property or a tax receipt to identify it distinctly. Do not forget to include the Property Account Number or Statement Number.

- Enter the Final Judgment Cause Number. Ensure that the entire number is accurately recorded.

- In the Assignment of Right to a Refund section, confirm that you are the property owner or a representative authorized to act on their behalf. Clearly state the name of the property owner in the designated space.

- Select one of the options provided for where the refund should be sent. If a different address for the property owner is required, fill it in as specified. If designating an attorney or another individual, provide their name and complete mailing address.

- Sign and date the form where indicated to validate the assignment of the refund rights.

- Once the form is fully completed, save your changes. You have the option to download, print, or share the form as necessary for submission.

Complete your TX Comptroller 50-765 form online today for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To find your Texas tax account number, check official documents like past tax returns or correspondence from the Texas Comptroller's office. You can also access this information by logging into your online account on the Comptroller's website. Knowing your account number is essential for all dealings with the TX Comptroller 50-765.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.