Loading

Get Tx Comptroller 50-268 1999

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 50-268 online

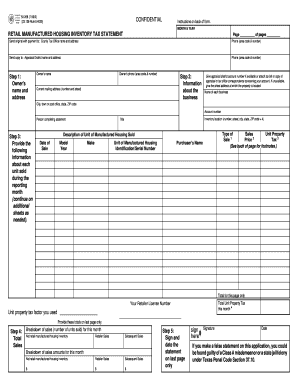

Filling out the TX Comptroller 50-268 form is essential for declaring your retail manufactured housing inventory tax. This guide provides a step-by-step approach to completing the form online, ensuring that users can efficiently report their inventory tax obligations.

Follow the steps to fill out the form accurately.

- Press the ‘Get Form’ button to access the TX Comptroller 50-268 form and launch it in the online editor.

- In the first section, enter the owner's name and the complete business address, including the owner's phone number. Make sure to include the relevant contact information accurately.

- Fill out the business information, providing the current mailing address. List the appraisal district account number if available, along with the name of the person completing the statement.

- Next, provide details for each unit sold during the reporting month. Include the inventory location, type of sale, price, tax information, description of the unit, date of sale, model year, make, identification/serial number, and purchaser's name. Use additional sheets if more space is needed.

- Aggregate the total sales for all units sold and input these figures. Clearly distinguish between net retail manufactured housing inventory, retailer sales, and subsequent sales.

- On the last page of the form, sign and date the statement. Ensure that this step is completed as omitting a signature may result in filing penalties.

- Finally, before submitting, save changes made to the form. Users can then download a copy, print it for their records, or share it with relevant parties.

Complete your TX Comptroller 50-268 form online today to stay compliant with tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To obtain your Texas Comptroller XT number, you must register your business with the Texas Comptroller's office. You will receive your XT number during the registration process. This number is crucial for various tax-related purposes and is tied to your TX Comptroller 50-268 filings, simplifying your interactions with the Comptroller's office.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.