Get Tx Comptroller 50-268 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 50-268 online

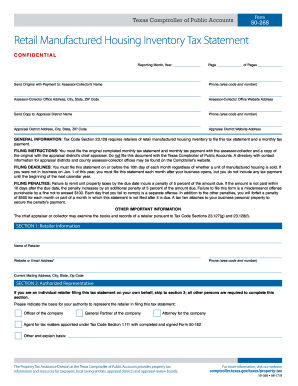

The TX Comptroller 50-268 form is essential for retailers of manufactured housing to document their inventory tax status each month. This guide will help users understand each section and field of the form, ensuring a smooth completion process.

Follow the steps to fill out the TX Comptroller 50-268 form accurately.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Fill in the reporting month and year at the top of the form, ensuring accuracy as this will reflect the period of your inventory reporting.

- In Section 1, enter the retailer's name and contact details, including their website or email address, and phone number. Additionally, provide the current mailing address.

- If applicable, complete Section 2 by identifying the authorized representative's title and contact information. This section is necessary for individuals representing the retailer.

- In Section 3, complete the business information fields, including the name of the business, its physical location, and the retailer license number.

- Section 4 requires detailed inventory information for each sale during the reporting month. List the type of sale for each transaction, followed by the sales price and unit property tax.

- Continue detailing the sales in Section 4, ensuring compliance with the inventory types and other specifics outlined in the form.

- In Section 5, report the number of units sold and provide the total transaction amounts for retailer sales and subsequent sales.

- Lastly, in Section 6, the retailer or authorized representative must sign and date the form to verify the truthfulness of the information provided.

- Once the form is completed, users can save changes, download, print, or share the form as required for submission.

Complete your TX Comptroller 50-268 form online today to ensure timely and accurate filing.

Get form

Related links form

Special inventory tax in Texas refers to a specific tax applicable to certain types of business inventory. This tax is assessed on businesses holding inventory for sale and is due on January 1 each year. Understanding this tax can be crucial for businesses to ensure compliance and avoid penalties. For guidance on managing inventory tax obligations, consider utilizing uslegalforms, particularly regarding TX Comptroller 50-268.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.