Get Tx Comptroller 50-266 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 50-266 online

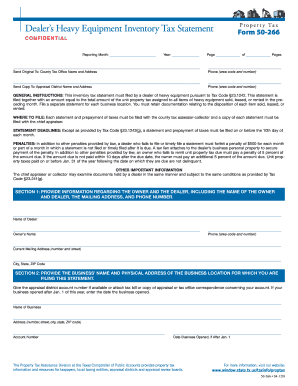

Filling out the TX Comptroller 50-266 form is essential for dealers of heavy equipment to accurately report their tax liabilities. This guide provides a comprehensive, step-by-step approach to help users complete the form online with ease and confidence.

Follow the steps to accurately fill out the TX Comptroller 50-266 online.

- Press the ‘Get Form’ button to acquire the TX Comptroller 50-266 form and open it in your preferred editor.

- In Section 1, provide accurate information regarding the owner and dealer, including the name of the dealer, owner's name, current mailing address, and phone number.

- In Section 2, enter the business name and physical address for the filing statement. Include the appraisal district account number if available and the date your business opened, if after January 1.

- In Section 3, fill out information regarding each sale, lease, or rental of heavy equipment during the reporting month. You may also attach separate documentation if preferred, ensuring it is clearly labeled as per the column headers.

- In Section 4, complete the boxes to summarize the number of units sold, leased, or rented and their respective transaction amounts for the month.

- Finally, in Section 5, sign and date the statement. Ensure that the name of the dealer is included, along with the authorized signature, printed name, and title.

- After filling out the form, save any changes, and consider downloading, printing, or sharing the completed TX Comptroller 50-266 form as needed.

Start filling out your documents online today to meet your reporting requirements.

Get form

Related links form

Special inventory tax in Texas applies to specific types of inventory held by certain businesses, such as manufacturers or wholesalers. The TX Comptroller 50-266 specifies how this tax is imposed and which types of inventory qualify. Understanding your business’s obligations under this tax can help you avoid unexpected liabilities. Consider leveraging uslegalforms to clarify your responsibilities and stay compliant.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.