Loading

Get Tx Comptroller 50-260 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 50-260 online

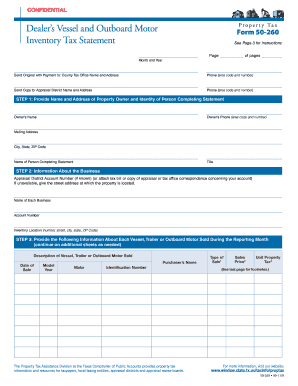

Filling out the TX Comptroller 50-260, also known as the dealer’s vessel and outboard motor inventory tax statement, is essential for managing your property tax obligations. This guide provides clear instructions to assist you in completing the form accurately and efficiently.

Follow the steps to effectively complete the TX Comptroller 50-260 online.

- Press the ‘Get Form’ button to acquire the form and access it in the editor.

- Enter the name and address of the property owner in the designated fields. Ensure to include the owner's phone number. Additionally, input the name of the person completing the statement and their title.

- Provide information about the business. This includes the appraisal district account number if known, or the street address if not. Fill in the name of each business, the account number, and the location of inventory.

- List each vessel, trailer, or outboard motor sold during the reporting month. Include the description of the item, sale date, model year, make, identification number, purchaser's name, type of sale, sales price, and unit property tax. Continue on additional sheets as needed.

- Summarize total sales by breaking down the number of units sold for this month, including net vessel, trailer, and outboard motor inventory, fleet sales, dealer sales, and subsequent sales.

- Provide total sales amounts for this month for each category listed in the previous step.

- Finally, sign and date the form to confirm its accuracy. Ensure that the information is completed fully before submission.

- Save any changes made to the form, and download or print a copy if necessary. You can also share the form if required.

Complete your TX Comptroller 50-260 online today to ensure compliance with tax obligations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To request a refund for Texas franchise tax, file your refund claim using the TX Comptroller's approved form. Ensure your information is complete, and include any required documentation that supports your claim. If you're uncertain, US Legal Forms offers user-friendly resources to help you navigate the process smoothly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.