Loading

Get Tx Comptroller 50-246 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 50-246 online

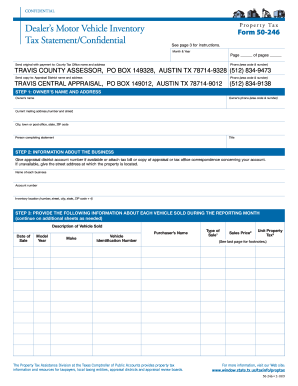

Filling out the TX Comptroller 50-246 form online is essential for motor vehicle dealers to report their inventory for property tax purposes. This guide will provide clear, step-by-step instructions to help users navigate the process with ease.

Follow the steps to complete the TX Comptroller 50-246 form online successfully.

- Click ‘Get Form’ button to obtain the TX Comptroller 50-246 document and open it in the editor.

- Provide the owner’s name and address in the designated fields. Ensure to include the corporate, sole proprietorship, or partnership name, along with the mailing address and phone number.

- Fill in information about the business including the appraisal district account number, or attach a tax bill or relevant correspondence. If not available, include the street address of the property.

- Enter the details of each vehicle sold during the reporting month. This includes the description of the vehicle, date of sale, model year, make, vehicle identification number, purchaser’s name, type of sale, sales price, and unit property tax. Ensure to continue on additional sheets if necessary.

- Provide total sales information. Summarize the number of units sold in categories such as net motor vehicle inventory, fleet sales, and dealer sales.

- On the last page of the form, sign and date the statement. Make sure you are the individual who completed the form.

- After completing all sections of the form, save your changes, then download or print the form. Ensure to send the original form with payment to your County Tax Office and a copy to the appraisal district.

Complete your TX Comptroller 50-246 form online today to ensure compliance and timely submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Avoiding car sales tax in Texas can be tricky, but it is possible under certain circumstances. Look for exemptions such as family transfers or using a trade-in vehicle, which can reduce your taxable amount. Additionally, thoroughly review the TX Comptroller 50-246 to see if your situation qualifies for any exemptions, simplifying your process and potential savings.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.