Get Tx Comptroller 50-246 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 50-246 online

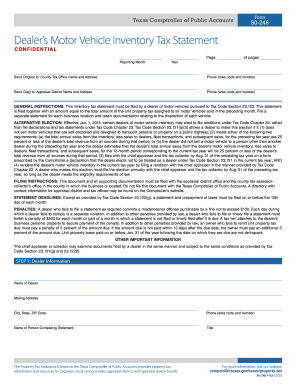

Filling out the TX Comptroller 50-246 form, also known as the Dealer’s Motor Vehicle Inventory Tax Statement, is essential for representing motor vehicle sales accurately. This guide will walk you through each section and field of the form to ensure you complete it correctly and efficiently.

Follow the steps to complete the TX Comptroller 50-246 form online.

- Press the ‘Get Form’ button to obtain the form and open it in your editing software.

- In the first section, provide the dealer's information, including the name, mailing address, city, state, ZIP code, phone number, the name of the person completing the statement, and their title.

- Next, enter the business's name and physical address. If available, include the appraisal district account number or attach relevant tax bills or correspondence.

- In the vehicle inventory information section, detail each motor vehicle sale within the reporting month, including the description of the vehicle, date of sale, model year, make, vehicle identification number, purchaser’s name, type of sale, sales price, and unit property tax. If there are multiple vehicles, continue on additional sheets as needed.

- Input the total number of units sold during the reporting month. Categorize the sales into motor vehicle inventory, fleet transactions, dealer sales, and subsequent sales, providing sales amounts where applicable.

- The final section requires your signature and date on the last page. Ensure all information is accurate, as providing false information can have legal consequences.

- After completing the form, save your changes, download a copy for your records, and print the form if required.

Complete your TX Comptroller 50-246 form online to ensure accurate reporting of motor vehicle inventory taxes.

Related links form

Filing the Texas Franchise Tax form requires you to gather your business's financial information, including revenues and expenses for the reporting period. You can file online through the Texas Comptroller's website or by mail, depending on your preference. Make sure to check the specific filing deadlines for the TX Comptroller 50-246 to avoid penalties. US Legal Forms offers templates and resources that can help you accurately complete and submit this form.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.