Get Tx Comptroller 50-144 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 50-144 online

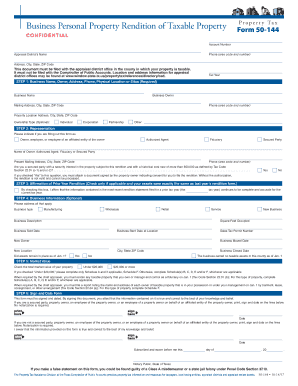

This guide provides clear instructions on how to complete the Texas Comptroller Form 50-144, which is essential for reporting business personal property for taxation purposes. Follow this comprehensive and user-friendly guide to ensure accurate submission.

Follow the steps to successfully complete the TX Comptroller 50-144 online.

- Click ‘Get Form’ button to obtain the form and access it in the online platform for editing.

- Enter your account number in the designated field at the top of the form. This information is necessary for the appraisal district.

- Provide the appraisal district's name and their phone number in the appropriate sections, ensuring accuracy for any follow-up communications.

- Complete the business name, owner, mailing address, and physical location or situs fields. These details are crucial for identifying your business.

- Indicate your ownership type, selecting from options such as individual, corporation, partnership, or other. This is optional but can affect your tax obligations.

- Select your role in filling out this form, choosing from owner, authorized agent, fiduciary, or secured party. This helps in establishing who is responsible for the information.

- If you are a secured party with a security interest over $50,000 in the property, check ‘Yes’ and attach the necessary consent documentation from the property owner.

- If applicable, affirm that the details provided match the prior year’s rendition by checking the corresponding box.

- Fill out the optional business information section, including the business type, description, square footage occupied, and relevant dates regarding the business.

- Determine the market value of your properties and indicate whether your business owned taxable assets in the county as of January 1.

- Proceed to fill in the schedules as required, detailing personal property and its estimated market values or historical costs based on the categories listed.

- Make sure to sign and date the form. If notarization is required, ensure that the document is properly sworn.

- Review all entries for accuracy, then save your changes, and download, print, or share the completed form as necessary.

Complete your TX Comptroller 50-144 form online today for efficient processing of your business personal property taxes.

Get form

Related links form

Property tax form 50-144 is used in Texas to apply for property tax exemptions for individuals who meet specific criteria. This form plays a crucial role in helping applicants reduce their tax liabilities based on certain qualifying conditions, including disability and age. Completing the TX Comptroller 50-144 form accurately ensures that you leverage the tax benefits available to you. USLegalForms offers resources to help you navigate this form and optimize your filing process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.