Get Tx Comptroller 50-144 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

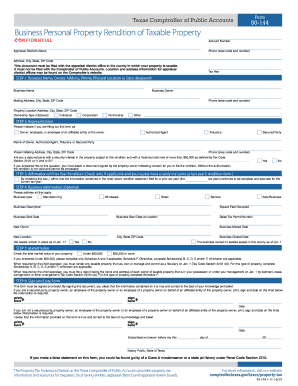

Tips on how to fill out, edit and sign TX Comptroller 50-144 online

How to fill out and sign TX Comptroller 50-144 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Tax form completion can turn into a significant hurdle and major inconvenience without proper guidance provided.

US Legal Forms is designed as an online solution for TX Comptroller 50-144 electronic filing and offers numerous benefits for taxpayers.

Utilize US Legal Forms to ensure secure and straightforward TX Comptroller 50-144 completion.

- Acquire the template on the website in the appropriate section or through the search engine.

- Click the orange button to access it and wait for it to load.

- Review the form and follow the instructions. If you have never filled out the form before, follow the line-by-line instructions.

- Focus on the highlighted fields. These are fillable and require specific information to be entered. If you are unsure what information to input, refer to the instructions.

- Always sign the TX Comptroller 50-144. Use the integrated tool to create the electronic signature.

- Select the date field to automatically insert the correct date.

- Review the form to verify and edit it before e-filing.

- Press the Done button in the top menu once you have finished it.

- Save, download, or export the completed form.

How to alter Get TX Comptroller 50-144 2016: customize forms online

Filling out documents is simpler with intelligent online resources. Get rid of paperwork with easily accessible Get TX Comptroller 50-144 2016 templates that you can alter online and print.

Preparing documents and paperwork needs to be more attainable, whether it’s a routine part of one’s profession or an occasional task. When someone needs to submit a Get TX Comptroller 50-144 2016, researching guidelines and how to properly complete a form and what it should encompass can be time-consuming and labor-intensive. Nevertheless, if you discover the appropriate Get TX Comptroller 50-144 2016 template, completing a document will cease to be difficult with an efficient editor available.

Uncover a wider variety of functions you can incorporate into your document workflow. There's no need to print, complete, and annotate forms by hand. With an intelligent editing system, all vital document processing features are readily available. If you aim to enhance your workflow with Get TX Comptroller 50-144 2016 forms, locate the template in the repository, click on it, and uncover a simpler method to fill it out.

If the form requires your initials or date, the editor provides features for that as well. Minimize the chance of mistakes by employing the Initials and Date instruments. You can also append custom graphic elements to the form. Use the Arrow, Line, and Draw tools to personalize the file. The more tools you are acquainted with, the easier it is to work with Get TX Comptroller 50-144 2016. Explore the solution that provides everything necessary to find and modify forms in a single tab in your browser and eliminate manual paperwork.

- If you desire to insert text in an arbitrary section of the form or add a text field, employ the Text and Text field tools to expand the text in the form as much as you need.

- Utilize the Highlight tool to emphasize the important parts of the form.

- If you wish to hide or eliminate particular text segments, make use of the Blackout or Erase functionalities.

- Personalize the form by incorporating default graphic elements to it.

- Utilize the Circle, Check, and Cross features to add these components to the forms, if needed.

- If you need more annotations, use the Sticky note tool and place as many notes on the forms page as you require.

Get form

Related links form

In Texas, certain exemptions from property taxes apply after the death of a property owner. Surviving spouses and individuals with disabilities may qualify for continued tax exemptions. Familiarize yourself with the TX Comptroller 50-144 regulations to understand the criteria and process for claiming these benefits. Navigating these exemptions can provide relief during a challenging time.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.