Loading

Get Tx Comptroller 50-135 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 50-135 online

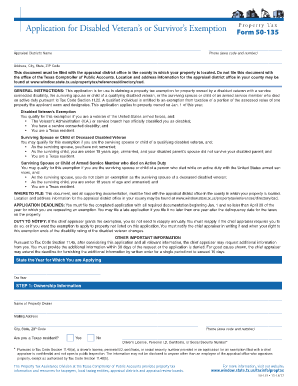

Filling out the TX Comptroller 50-135 form is an essential step for disabled veterans and their survivors to claim property tax exemptions. This guide will walk you through each section of the form, ensuring you understand the requirements and can complete it with confidence.

Follow the steps to effectively complete the TX Comptroller 50-135 form online.

- Press the ‘Get Form’ button to access the TX Comptroller 50-135 form. This will open the document in your online editor.

- Begin by entering the ownership information. Provide the name of the property owner, their mailing address, city, state, and ZIP code. Indicate whether they are a Texas resident by selecting 'Yes' or 'No' and include their phone number.

- Move on to the property information section. Enter the address of the property, along with the legal description, if known, and the appraisal district account number when available. If applicable, include details about the manufactured home, such as the make, model, and identification number.

- In the type of exemption and qualifications section, check the appropriate exemption you are applying for: Disabled Veteran's Exemption, Surviving Spouse or Child of a Deceased Disabled Veteran, or Surviving Spouse or Child of Armed Service Member who died on Active Duty. Be sure to provide the veteran's name, branch of service, serial number, and disability rating.

- If you are filing a late application, indicate that eligibility was claimed last year and provide the prior tax year.

- Once you have reviewed all entries for accuracy, you can save changes to the document, download it for your records, print it for submission, or share it as required.

Complete your documents online to effectively manage your property tax exemptions with ease.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, in Texas, 100% disabled veterans receive a complete property tax exemption. This exemption recognizes the sacrifices made by veterans and offers crucial financial relief. The TX Comptroller 50-135 information ensures that veterans understand their rights and the process to apply for these benefits.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.