Loading

Get Tx Comptroller 50-135 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 50-135 online

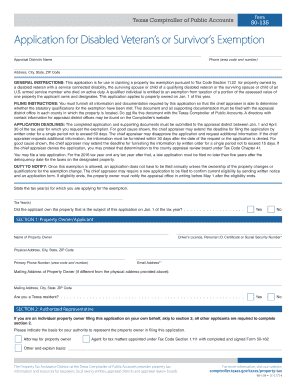

Filling out the TX Comptroller 50-135 online is a crucial step in applying for a Disabled Veteran’s or Survivor’s Exemption. This guide provides clear instructions to help users navigate the form efficiently and effectively.

Follow the steps to complete the application accurately.

- Press the ‘Get Form’ button to access the application. This will open the form in an editable format, allowing you to enter your information.

- Indicate the tax year(s) for which you are applying for the exemption. Ensure that you clearly specify the relevant year(s) as it is essential for processing.

- Answer the question regarding property ownership on January 1 of the tax year. Mark 'Yes' or 'No' accordingly.

- In Section 1, fill in your full name as the property owner, along with your Driver’s License, Personal I.D. Certificate, or Social Security Number. Complete your physical address, including the city, state, and ZIP code.

- Provide your primary phone number and email address. If your mailing address differs from your physical address, include that information as well.

- Confirm your residency status by selecting ‘Yes’ or ‘No’ to the question regarding Texas residency.

- If applicable, complete Section 2, which requests information about an authorized representative, including their name, title, phone number, and address.

- In Section 3, provide detailed property descriptions, including the property's physical address, Appraisal District Account Number, manufactured home details, and legal descriptions, if necessary.

- In Section 4, mark the appropriate exemption you are applying for and include the veteran’s name, branch of service, serial number, and disability rating as required.

- Attach any additional documents needed, especially if the exemption is based on a veteran’s disability rating.

- Complete Section 6 with the printed name and signature of the property owner or authorized representative, followed by the date.

- Finally, save your changes, and consider downloading or printing a copy for your records before submitting the document to your local appraisal district.

Get started with your document submission online today!

Tax forgiveness for disabled adults in Texas is available to those who have a qualifying disability as outlined by state statutes. To receive this forgiveness, applicants must demonstrate their eligibility and file the appropriate forms, including the TX Comptroller 50-135. Utilizing platforms like USLegalForms can simplify this process and guide you through the necessary steps.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.