Loading

Get Tx Comptroller 50-114 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 50-114 online

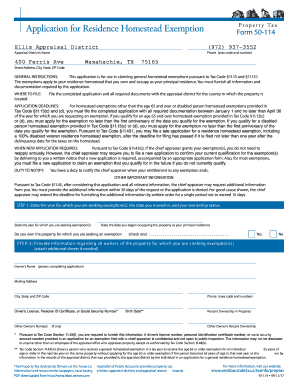

Filling out the TX Comptroller Form 50-114 is essential for claiming a residence homestead exemption on your property. This guide provides step-by-step instructions to help you complete the form accurately and efficiently, ensuring you maximize your potential tax benefits.

Follow the steps to complete the TX Comptroller 50-114 online.

- Press the ‘Get Form’ button to retrieve the form and open it for editing.

- Indicate the year for which you are seeking exemptions and the date you moved into the property. Then, confirm your ownership status by checking the appropriate box: 'Yes' if you own the property or 'No' if you do not.

- Provide information about the owners of the property. Include the owner’s name, mailing address, and percent ownership. If there are multiple owners, include their names and ownership percentages.

- Describe the property by entering the street address, legal description (if known), and appraisal district account number (if known). Specify the number of acres used for residential occupancy.

- Select any applicable exemptions from the list provided. Indicate if you are requesting to transfer a tax ceiling. Review the qualifications for each exemption to ensure you are eligible.

- Attach required documents including a copy of your driver's license or state-issued ID, and a vehicle registration receipt or utility bill, as needed to verify your identity and residency.

- If applicable, indicate whether you have an exclusive right to occupy a unit in cooperative housing by selecting 'Yes' or 'No'.

- Read through the declaration, sign, and date the application to confirm that the information provided is true and correct.

Complete your tax documents online today and ensure you receive your homestead exemption.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, a homestead exemption effectively lowers your property taxes in Texas. When you apply for this exemption, it reduces the taxable value of your home, which ultimately decreases your tax bill. This benefit is established under the TX Comptroller 50-114, designed to support homeowners. It is a valuable tool for managing property expenses.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.