Get Tx Comptroller 50-114 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 50-114 online

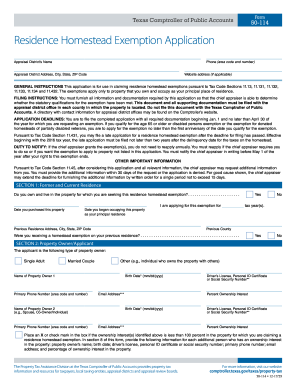

This guide provides clear instructions on how to complete the TX Comptroller 50-114, the Residence Homestead Exemption Application, online. By following these steps, users will be able to efficiently fill out the form and ensure they qualify for the appropriate tax exemptions.

Follow the steps to fill out the form correctly.

- Use the ‘Get Form’ button to access the 50-114 application and open it in your editing platform.

- In Section 1, indicate if you own and occupy the property for which you are applying for the exemption by selecting 'Yes' or 'No'. Additionally, provide the purchase date and the date you began occupying the residence as your principal home.

- In Section 2, provide your personal details. This includes the type of property ownership and information for all property owners, including name, identification number, birth date, ownership percentage, and contact details.

- Move to Section 3, where you will check off the specific types of residence homestead exemptions you may qualify for, ensuring to carefully read the qualifications outlined for each option.

- In Section 4, provide the physical address of the property along with the legal description and appraisal district account information if available. Additionally, confirm if any portion of the property is income-producing.

- Proceed to Section 5 to attach required documentation such as a copy of your driver’s license or ID that matches the address of the property. Indicate if you qualify for exemptions to this requirement.

- In Section 6, indicate any tax limitation or exemption transfer requests, if applicable, by marking the appropriate options.

- Complete Section 7 if the residence is a manufactured home, including necessary documentation confirming ownership.

- In Section 8, disclose any other residential properties you own in Texas.

- Finally, complete Section 9 by affirming the truthfulness of your application. Sign and date the form. Ensure that any authorized representative includes their evidence of authority.

- After filling out the form, save the changes you made and choose to download, print, or share the completed application as needed.

Begin your application process for the residence homestead exemption online today!

Get form

Related links form

Homestead exemptions are calculated by deducting the exemption amount from the appraised value of your property. Each state may have different procedures, but in Texas, the TX Comptroller administers the rules and ensures that eligible homeowners receive their rightful benefits. To better understand your specific situation, utilizing services like US Legal Forms can help clarify the process and requirements.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.