Loading

Get Tx Comptroller 50-114 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 50-114 online

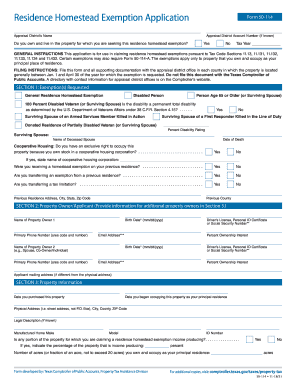

This guide provides clear instructions on how to complete the Residence Homestead Exemption Application, Form 50-114, online. By following these steps, users will be able to successfully apply for the residence homestead exemption applicable to their property.

Follow the steps to complete the Residence Homestead Exemption Application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the appraisal district’s name and account number if known. Indicate whether you own and live in the property for which you are seeking the exemption by selecting 'Yes' or 'No'. Specify the tax year for which you are applying.

- Proceed to Section 2, where you will enter the property owner/applicant information. Include names, social security numbers or driver’s license numbers, birth dates, contact details, and ownership interests for all property owners.

- Section 4 is where you indicate any waivers from required documentation, including exemptions available for certain individuals. Be sure to provide the name and address of the relevant facility if applicable.

Complete your Residence Homestead Exemption Application online today to ensure you receive your benefits in a timely manner.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Once you submit the TX Comptroller 50-114 application, it generally takes about 30 days for your homestead exemption request to be processed. During this period, your local appraisal district may review your application. Stay in touch with them for updates. Once granted, the exemption will apply to your property taxes for the current and future tax years.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.