Get Tx Comptroller 12-302 2004

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 12-302 online

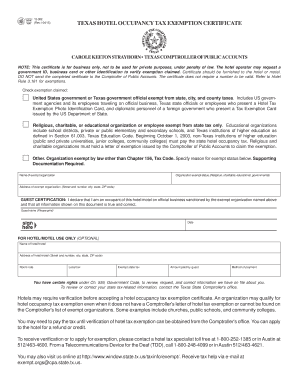

The Texas Hotel Occupancy Tax Exemption Certificate (Form 12-302) is essential for businesses seeking to exempt themselves from state hotel taxes. This guide provides a clear, step-by-step approach to successfully completing the form online.

Follow the steps to complete the TX Comptroller 12-302 form online.

- Click the ‘Get Form’ button to access the document and open it in the editor.

- Begin by checking the exemption claimed. You can select from options such as: United States government or Texas government official, religious, charitable or educational organization, or other exemptions.

- If claiming an exemption based on an organization, provide the name of the exempt organization in the appropriate field.

- Next, indicate the type of exempt status, such as religious, charitable, educational, or governmental, by selecting the relevant option.

- Fill in the address of the exempt organization, including the street number, city, state, and ZIP code.

- In the guest certification section, enter the name of the guest (occupant) clearly, ensuring accuracy.

- Add the date of occupancy in the designated field.

- If applicable, the hotel or motel may fill out their section which includes details such as the name, address, room rate, local tax, exempt state tax, amount paid by the guest, and method of payment.

- Once all sections are complete, review the form for accuracy and clarity before proceeding to save changes, download, print, or share the completed form as needed.

Complete your hotel occupancy tax exemption certificate online today and ensure you receive the benefits your organization qualifies for.

Get form

Related links form

Filing for property tax exemption in Texas involves completing the appropriate application form and submitting it to your local appraisal district. The TX Comptroller 12-302 provides a clear outline of the process and the forms required. Be meticulous in including all necessary information and documentation to avoid delays. You might find it helpful to explore uslegalforms for resources that can guide you through the paperwork efficiently.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.