Loading

Get Tx Comptroller 06-125 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 06-125 online

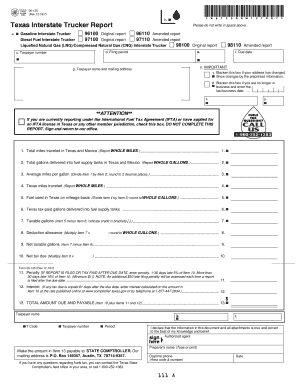

The TX Comptroller 06-125 form is essential for interstate truckers reporting gasoline, diesel, or LNG/CNG fuel usage. This guide will provide step-by-step instructions to help you accurately complete the form online.

Follow the steps to complete the TX Comptroller 06-125 form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your correct taxpayer number in field c. This number is shown on your fuels tax license.

- Fill in field d with the correct ending month and year of the calendar quarter or year for which the report is filed.

- In field g, provide your taxpayer name and complete mailing address.

- Report the total miles traveled in Texas and Mexico in item 1, ensuring to report whole miles.

- Input the total gallons delivered into vehicle fuel supply tanks in Texas and Mexico in item 2, also reporting whole gallons.

- Calculate the average miles per gallon by dividing item 1 by item 2 and rounding to two decimal places for item 3.

- Enter the total miles traveled in Texas in item 4, ensuring to report whole miles.

- To find the taxable gallons of fuel used in Texas, divide the number in item 4 by the average in item 3 for item 5, rounding to whole gallons.

- In item 6, enter the total number of tax-paid gallons delivered into fuel supply tanks in Texas.

- Subtract item 6 from item 5 and enter the result in item 7, indicating credit in brackets if necessary.

- If applicable, multiply the number in item 7 by 0.005 for item 8 (only for LNG/CNG) and round to whole gallons.

- Subtract item 8 from item 7 for item 9.

- Multiply the number in item 9 by the current tax rate to determine the tax owed for item 10.

- If your report is filed late, calculate the penalty and enter it in item 11, adhering to the outlined penalties.

- Calculate the interest for any unpaid tax in item 12 based on the guidelines provided.

- Add the amounts in items 10, 11, and 12 to find the total amount due in item 13.

- Finally, review all entries for accuracy, then save changes, download, print, or share the completed form as necessary.

Fill out the TX Comptroller 06-125 form online today for accurate and efficient reporting.

Filing sales tax in Texas online is easy via the Texas Comptroller’s online services. You will need to provide details from your TX Comptroller 06-125 form during the process. Ensure you gather all required sales data to complete your filing. For additional help, uslegalforms is a great resource that offers support and templates for seamless filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.