Get Tx Comptroller 05-391 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 05-391 online

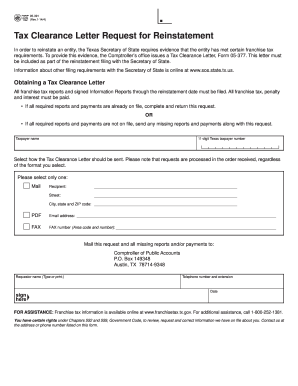

Filling out the TX Comptroller Form 05-391 is an essential step for entities seeking to reinstate their status with the Texas Secretary of State. This guide will provide you with clear, step-by-step instructions to help you navigate the online process efficiently.

Follow the steps to complete the Tax Clearance Letter Request for Reinstatement.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the taxpayer name in the designated field. This should be the name of the entity that requires reinstatement.

- Provide the 11-digit Texas taxpayer number, which is unique to your entity. Ensure that this number is correct to avoid processing delays.

- Select the preferred method for receiving the Tax Clearance Letter by choosing one option: Mail, PDF, or FAX. Only one option should be selected.

- If you choose Mail, fill out the recipient's name, street address, city, state, and ZIP code. Ensure all information is accurate for timely delivery.

- If you select PDF, include the email address where the Tax Clearance Letter should be sent. Make sure the email address is valid.

- For FAX requests, provide the FAX number, including the area code, where the Tax Clearance Letter should be sent.

- Next, you will need to include information regarding the requestor. Type or print your name clearly, followed by your telephone number and extension.

- Finally, input the date of the request, which should reflect the current date when you are filling out the form.

- Once all fields are completed, review your entries for accuracy. You can then save your changes, download the completed form, print it, or share it as needed.

Ready to complete your request? Fill out the TX Comptroller 05-391 online today.

Get form

Related links form

Neglecting to file your Texas franchise tax can lead to significant penalties, including fees and interest on the unpaid taxes. The Texas Comptroller takes this very seriously, as outlined in the TX Comptroller 05-391. Additionally, not filing can jeopardize your business's standing and result in involuntary dissolution. To avoid these issues, it’s best to file on time, and U.S. Legal Forms can assist with the process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.