Loading

Get Tx Comptroller 05-166 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 05-166 online

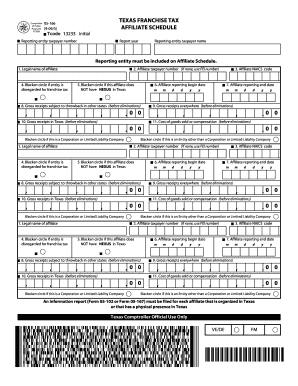

The Texas Franchise Tax Affiliate Schedule, Form 05-166, is a vital document for reporting the financial activities of affiliates related to a reporting entity. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and effectively online.

Follow the steps to successfully complete your TX Comptroller 05-166 form.

- Press the ‘Get Form’ button to access the form and open it in an editor.

- Enter the initial reporting entity taxpayer number in the designated field to identify your entity.

- Fill in the report year to indicate the time period relevant to the report.

- Specify the affiliate’s NAICS code to categorize the affiliate's primary business activities.

- Fill in the gross receipts for the affiliate everywhere, before any eliminations.

- Report the cost of goods sold or compensation before eliminations in the appropriate section.

- Check the relevant circle if the affiliate is a corporation or limited liability company, or another type of entity.

- Once completed, users can save changes, download, print, or share the form as needed.

Complete your TX Comptroller 05-166 form online today for efficient document management.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, the TX Comptroller has the authority to freeze a bank account as part of its collection efforts for unpaid taxes. This action usually occurs when a taxpayer fails to meet financial obligations associated with franchise taxes. If this happens to you, taking timely steps and using services like USLegalForms can help resolve the issue effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.