Loading

Get Tx Ap-178 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX AP-178 online

The Texas Application for International Fuel Tax Agreement License (TX AP-178) is a crucial document for entities operating qualified motor vehicles across multiple jurisdictions. This guide provides clear instructions to assist users in completing the form online, ensuring compliance with tax obligations.

Follow the steps to successfully complete the TX AP-178 online.

- Click ‘Get Form’ button to access the TX AP-178 document and open it in the editor.

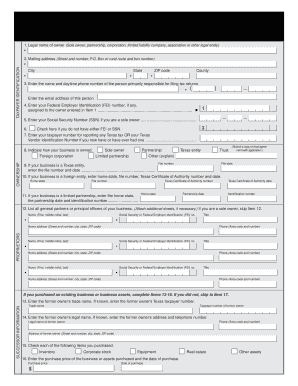

- In Item 1, enter the legal name of the owner, which could be a sole owner, partnership, corporation, limited liability company, association, or other legal entity.

- Proceed to Item 2 and provide the mailing address where you would like to receive correspondence from the Comptroller of Public Accounts.

- In Item 3, include the name and daytime phone number of the person primarily responsible for filing tax returns, along with their email address.

- For Item 4, input your Federal Employer Identification number. If you are a sole owner, also provide your Social Security number in Item 5.

- In Item 6, check the box if you do not have either an FEI or SSN.

- Enter your Texas Taxpayer Identification Number in Item 7 and check the ownership type in Item 8.

- If your business is a Texas entity, provide the file number and date in Item 9.

- For foreign entities, complete Item 10 with the home state, file number, and Texas Certificate of Authority number.

- List all general partners or principal officers in Item 12, attaching additional sheets if necessary.

- Complete Items 18 through 26 with your trade name, business location, bank information, and other relevant licensing details.

- In Item 27, indicate the number of motor vehicles requiring IFTA decals.

- Finally, review and confirm all entries, sign where indicated, and proceed to save changes, download, print, or share the completed form.

Complete your TX AP-178 online today to ensure compliance with your fuel tax obligations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To receive your IFTA sticker in Texas, you'll need to file an IFTA application. This requires details about your fleet of vehicles and related tax information. Once your application is approved, you will receive your IFTA stickers, which must be applied to your trucks. Using the TX AP-178 can help streamline this process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.