Loading

Get Tx 06-168 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX 06-168 online

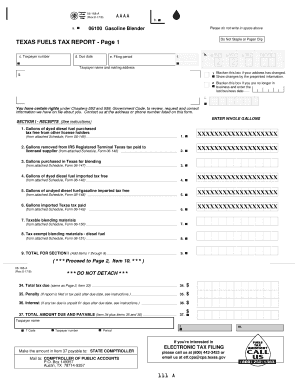

This guide provides a comprehensive overview of the Texas Fuels Tax Report (Form TX 06-168), designed to assist users in completing the form online. Follow these step-by-step instructions to ensure accurate and efficient submission.

Follow the steps to accurately complete the TX 06-168 form online.

- Click ‘Get Form’ button to obtain the TX 06-168 form and open it in the editor.

- Begin with the taxpayer information section. Enter the taxpayer number, name, mailing address, due date, and filing period. If your address has changed or if you are no longer in business, blacken the appropriate boxes and indicate the changes.

- Proceed to Section I, which covers receipts. Enter the gallons of dyed diesel fuel purchased tax-free, removed from IRS registered terminals, imported, and other relevant data as required. You may need to reference attached schedules (Forms 06-145, 06-146, etc.) for detailed information.

- Continue to Section II to report disbursements. Here you will provide details on blended gallons sold, gallons sold to unlicensed entities, and other sales and uses of dyed diesel fuel. Again, consult the attached schedules (Forms 06-152, 06-153, etc.) to assist with accurate reporting.

- In Section III, calculate the total tax due based on the net taxable gallons reported. This section may include additional calculations for penalties or interest, depending on your filing status.

- Finally, review all entered information for accuracy. Save changes regularly, and once completed, download a copy or print the form for your records. Follow the instructions for submission, ensuring it is sent to the appropriate address.

Start completing your TX 06-168 form online today to ensure timely and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Businesses engaging in taxable sales or services in Texas must register with the Comptroller. This includes sole proprietors, partnerships, and corporations. Ensure compliance with tax laws by using resources like the TX 06-168 feature on the US Legal Forms platform.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.