Get Tn Rv-f1300901 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TN RV-F1300901 online

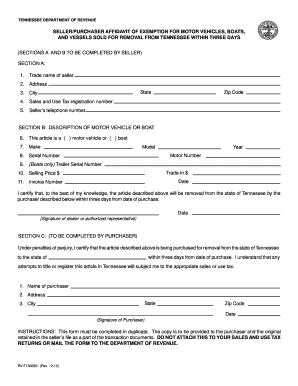

The TN RV-F1300901 form is essential for documenting the sale of motor vehicles, boats, and vessels that will be removed from Tennessee within three days. This guide provides clear, step-by-step instructions to help users fill out the form accurately and efficiently, ensuring a smooth transaction process.

Follow the steps to complete the TN RV-F1300901 form online.

- Use the ‘Get Form’ button to access the TN RV-F1300901 online and open the document in your preferred editor.

- In Section A, provide the trade name of the seller, their address, city, state, zip code, sales and use tax registration number, and telephone number.

- Proceed to Section B where you will describe the vehicle or boat being sold. Indicate whether it is a motor vehicle or a boat by checking the appropriate box. Then fill in the make, model, year, motor number, and serial number.

- If applicable, for boats, enter the trailer serial number. Record the trade-in amount if any, and the selling price of the vehicle or boat. Finally, provide the date and the invoice number associated with the sale.

- The seller or authorized representative must certify the information by signing and dating the section, confirming the article will be removed from Tennessee within three days.

- In Section C, the purchaser will need to fill in their name, address, city, state, and zip code. They must also date the document and sign it to certify the purchase is for removal from the state of Tennessee.

- After completing all sections, ensure that the form is printed in duplicate, as one copy is to be provided to the purchaser while the original should be retained in the seller's records.

- Finally, save your changes, and you can then download, print, or share the completed form as required.

Complete the TN RV-F1300901 form online today to ensure your transaction is documented correctly.

Get form

To avoid sales tax on RV purchases, you can explore exemptions offered by Tennessee law. It’s important to complete the TN RV-F1300901 form correctly to present any claims for tax exemption. Investigating local regulations will aid in understanding eligibility criteria. Engaging with platforms like uSlegalforms can provide the necessary support and documentation to help streamline this process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.