Loading

Get Tn Rv-f1300701 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TN RV-F1300701 online

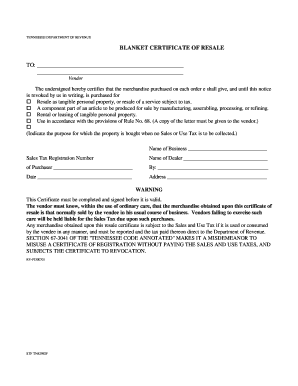

Filling out the TN RV-F1300701 form is a crucial step for individuals and businesses looking to complete a resale tax exemption accurately. This guide will provide clear and detailed instructions to assist users in completing the form effectively in an online format.

Follow the steps to complete the TN RV-F1300701 form online

- Click 'Get Form' button to obtain the form and open it in the editor.

- In the designated field, enter the name of the vendor to whom the certificate is addressed. This should be the business from which you are purchasing the merchandise.

- Complete the 'Name of Business' field with your business name. Ensure that this matches the name registered with the Sales Tax Registration Number.

- Input your Sales Tax Registration Number. This number is necessary for validating your exemption claim.

- Fill in the 'Name of Dealer' field with the name of the individual representing the vendor, if applicable.

- Complete the 'Purchaser' field with your name or the name of the individual completing the form, as they will be accountable for the information provided.

- In the 'By' field, provide the signature of the authorized person completing the form after reviewing it for accuracy.

- Enter the date on which the form is completed. This ensures the form's validity during the purchase.

- Finally, fill in the 'Address' field to include the physical address of your business. This helps establish your identity in the transaction.

- Review all entered information for completeness and accuracy. Once verified, you can save changes, download, print, or share the completed form as necessary.

Complete your documents online with confidence today.

An EIN is not the same as a vendor's license. The EIN is used for tax identification, whereas a vendor's license permits you to sell goods or services and is required to conduct business legally. For effective management of these documents, explore how the TN RV-F1300701 can assist you in understanding your regulatory needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.