Loading

Get Tn Dor Inh 301 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TN DoR INH 301 online

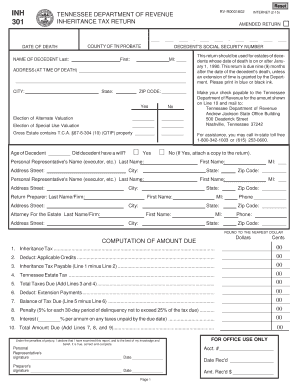

Filling out the TN DoR INH 301 form is an essential step in reporting the inheritance tax due on the estate of a decedent in Tennessee. This guide provides clear, comprehensive instructions to help you accurately complete the form online.

Follow the steps to fill out the TN DoR INH 301 online.

- Click ‘Get Form’ button to obtain the TN DoR INH 301 and open it in the online editor.

- Begin by entering the date of death of the decedent in the provided field. Ensure that the date is accurate and formatted correctly.

- Fill in the county of Tennessee where the probate is being held for the decedent's estate.

- Provide the full name of the decedent, including last name, first name, and middle initial.

- Indicate whether this is an amended return by checking 'Yes' or 'No'.

- Complete the decedent's address as it appeared at the time of death, including city, state, and ZIP code.

- For tax classification, indicate any specific elections such as alternate valuation or special use valuation by checking the appropriate boxes.

- Complete the gross estate section, answering if the estate contains certain designated property.

- Fill in the age of the decedent at the time of death.

- Answer whether the decedent had a will by selecting 'Yes' or 'No.' If 'Yes', attach a copy of the will.

- Complete the contact information for the personal representative or executor of the estate, including full name, address, and phone number.

- Fill out the taxation section, calculating the inheritance tax based on taxable estate and following the computation lines.

- Under 'Computation of amount due', complete each line carefully to arrive at the total amount due. Ensure all calculations are accurate.

- Review all entries for accuracy before finalizing the form.

- Once completed, save any changes made. You may then download, print, or share the form as needed.

Complete your inheritance tax return online today to ensure timely submission to the Tennessee Department of Revenue.

To file for an extension on franchise and excise tax in Tennessee, you need to submit a specific request before your original filing deadline. Be sure to include all required information to avoid any delays in processing. Accessing platforms like uslegalforms can simplify submitting your extension request. Don’t forget to review the relevant guidelines in the TN DoR INH 301.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.