Loading

Get Tn Dor Fae 173 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TN DoR FAE 173 online

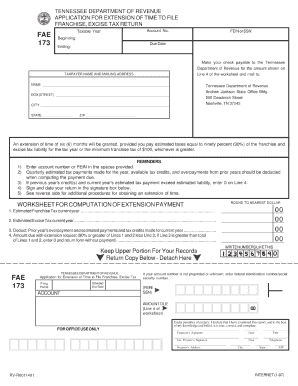

Filling out the TN DoR FAE 173 form online can streamline your application process and ensure accuracy. This guide provides clear, step-by-step instructions to help you navigate the form with confidence.

Follow the steps to effectively complete the TN DoR FAE 173 form.

- Click the ‘Get Form’ button to access the TN DoR FAE 173 form and open it in your preferred editor.

- Read the instructions provided on the form carefully. This will give you an overview of the required information and help you understand what is expected in each section.

- Begin filling out the personal information section. Provide accurate details such as your name, address, and contact information. Ensure that the information is legible and correctly spelled.

- Complete the purpose of the form section. Clearly state the reason for submitting the TN DoR FAE 173 form, ensuring that it aligns with the requirements outlined in the instructions.

- In the documentation section, upload any necessary supporting documents. Follow the guidelines for file types and sizes to ensure your submissions are accepted.

- Review all the information you have entered for accuracy. Double-check each field to confirm that there are no errors or missing data.

- Once you have completed the form and verified all details, save your changes. Look for options to either download a copy of the form, print it directly, or share it as needed.

Start completing your TN DoR FAE 173 form online today for a streamlined application experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To make a payment on your TNTAP account, log in to your account and navigate to the payments section. From there, you can select the amount and method of payment, ensuring it's processed securely. Regularly making these payments is essential for meeting obligations under the TN DoR FAE 173.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.