Get Tn Dor Fae 173 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign TN DoR FAE 173 online

How to fill out and sign TN DoR FAE 173 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Filling out a tax form can become a considerable challenge and a major inconvenience if appropriate guidance is not provided.

US Legal Forms serves as an online solution for TN DoR FAE 173 electronic filing and offers numerous benefits for taxpayers.

Save, download, or export the completed document.

- Obtain the form from the website in the specific section or through a search engine.

- Click the orange button to access it and wait for it to load.

- Examine the form and pay close attention to the instructions. If you haven't filled out this template before, adhere to the line-by-line directions.

- Focus on the highlighted fields. These are editable and require specific information to be entered. If you are unsure about what details to provide, consult the instructions.

- Always sign the TN DoR FAE 173. Utilize the integrated tool to create your electronic signature.

- Choose the date field to automatically input the correct date.

- Review the document to verify and revise it prior to submission.

- Press the Done button in the upper menu once you have finalized it.

How to revise Get TN DoR FAE 173 2012: personalize forms online

Your swiftly adjustable and configurable Get TN DoR FAE 173 2012 template is at your fingertips. Leverage our assortment with an integrated online editor.

Do you delay preparing Get TN DoR FAE 173 2012 because you simply don't know where to begin and how to proceed? We empathize with your situation and offer an excellent tool for you that has nothing to do with combating your procrastination!

Our online inventory of ready-to-customize templates allows you to browse and select from numerous fillable forms designed for a range of purposes and scenarios. However, accessing the file is just the beginning. We provide all the essential features to complete, validate, and alter the form of your preference without leaving our site.

All you need to do is to access the form in the editor. Review the wording of Get TN DoR FAE 173 2012 and confirm whether it's what you’re looking for. Start adjusting the template by utilizing the annotation tools to give your document a more structured and polished appearance.

In conclusion, alongside Get TN DoR FAE 173 2012, you'll receive:

With our professional solution, your finalized documents are typically legally binding and fully encrypted. We promise to protect your most sensitive information.

Acquire what is necessary to develop a professional-grade Get TN DoR FAE 173 2012. Make the intelligent choice and visit our foundation today!

- Insert checkmarks, circles, arrows, and lines.

- Highlight, obscure, and amend the existing text.

- If the form is intended for others as well, you can add fillable fields and distribute them for others to fill in.

- After you've finished altering the template, you can obtain the file in any available format or select any sharing or delivery options.

- A robust suite of editing and annotation tools.

- A built-in legally-binding eSignature capability.

- The option to create documents from scratch or based on the uploaded template.

- Compatibility with various platforms and devices for enhanced convenience.

- Multiple options for protecting your documents.

- A wide range of delivery methods for simpler sharing and distribution of documents.

- Adherence to eSignature frameworks governing the use of eSignature in online transactions.

Get form

Related links form

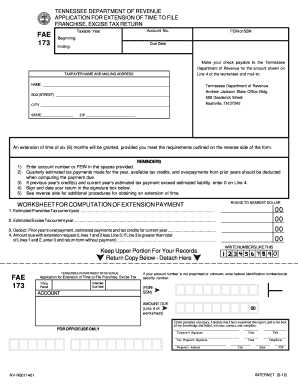

A franchise extension allows businesses additional time to file their franchise tax returns. By submitting Form FAE 173, businesses can avoid late fees and penalties. This time can be crucial for gathering necessary information to ensure accurate reporting.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.