Loading

Get Tn Bus 417 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TN BUS 417 online

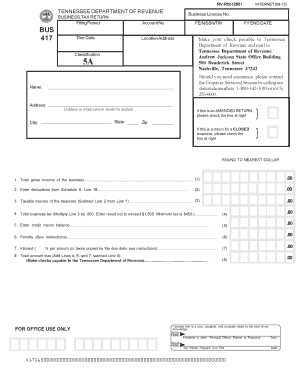

The TN BUS 417 is a crucial business tax return form for entities operating in Tennessee. This guide offers a step-by-step overview of how to accurately complete the form online, ensuring compliance with state requirements.

Follow the steps to fill out the TN BUS 417 online effectively.

- Click ‘Get Form’ button to obtain the TN BUS 417 form and open it in your online editor.

- Enter the filing period for the business tax return in the designated field.

- Provide the business license number, account number, and the Federal Employer Identification Number (FEIN), Social Security Number (SSN), or Tax Identification Number (TIN) in the specified sections.

- Fill in the location address of the business and the fiscal year end date.

- Indicate if this submission is an amended return or if it is for a closed business by checking the appropriate boxes.

- Complete the total gross income of the business in Line 1.

- Enter any deductions from Schedule A on Line 2.

- Calculate the taxable income of the business on Line 3 by subtracting Line 2 from Line 1.

- Calculate the total business tax on Line 4 by multiplying Line 3 by 0.003, noting the maximum and minimum tax limits.

- Provide the credit memo balance on Line 5.

- Calculate any penalties related to late filing on Line 6.

- Enter any applicable interest on Line 7.

- Sum the total amount due on Line 8 by adding Lines 4, 6, and 7, and subtracting Line 5.

- Sign the form in the area designated for the President, Principal Officer, Partner, or Proprietor, and include the date.

- If applicable, have the tax return preparer sign and date the form as well.

- Finally, save your changes, and choose the option to download, print, or share the completed form.

Complete your TN BUS 417 form online today to ensure timely and accurate filing.

While it's possible to file your business taxes yourself, it can be complicated, especially if you're unfamiliar with tax laws. DIY filing may lead to inaccuracies without proper resources. TN BUS 417 provides valuable tools that assist in filing your taxes correctly, ensuring you don’t miss important deductions. So, take advantage of platforms that simplify the tax process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.