Loading

Get Sd Rv-068 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SD RV-068 online

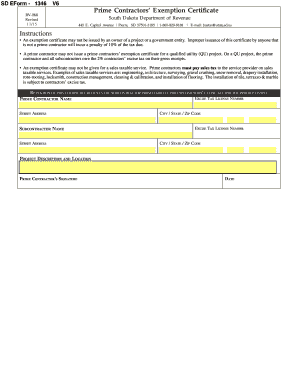

The SD RV-068 is a crucial document for prime contractors seeking an exemption certificate in South Dakota. This guide provides a clear and concise walkthrough to assist you in completing this form accurately and efficiently online.

Follow the steps to successfully complete the SD RV-068 online.

- Click ‘Get Form’ button to access the SD RV-068 and initiate the filling process.

- Enter your excise tax license number in the designated field. This is essential for verifying your status as a prime contractor.

- Provide the name of your business as the prime contractor. Ensure that it matches the name associated with your excise tax license.

- Fill in your street address, including your city, state, and ZIP code. This information is important for future correspondence.

- In the following section, input the excise tax license number of the subcontractor. This identifies the subcontractor involved in the project.

- Add the subcontractor's name and street address beneath the previous fields, ensuring clarity in your submission.

- Describe the project in detail within the allocated space. This should include the nature of the project and any relevant specifics.

- Fill in the city, state, and ZIP code where the project is taking place to ensure accurate location tracking.

- Once completed, sign and date the form in the designated areas to authenticate your submission as the prime contractor.

- Finally, review all entries for accuracy before you save changes, download, print, or share the completed form.

Complete your documents online to ensure a seamless and efficient process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Excise tax and specific tax are not the same, although they serve similar purposes. Excise tax, like that applied to the SD RV-068, typically focuses on specific goods, such as vehicles, while specific tax refers more broadly to the taxation of particular items. Understanding this difference can help you navigate the regulations more easily.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.