Loading

Get Sd Bfm-0001 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SD BFM-0001 online

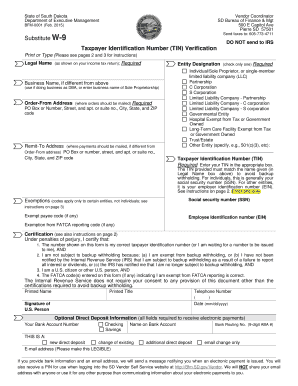

Filling out the SD BFM-0001 form is an important step for users who need to provide their taxpayer information to the South Dakota Bureau of Finance and Management. This guide will walk you through each section of the form, ensuring that you complete it accurately and efficiently.

Follow the steps to successfully fill out the SD BFM-0001 online.

- Press the ‘Get Form’ button to access the form and open it in your editor.

- Enter your legal name as it appears on your income tax return in the 'Legal Name' field. This is a required field.

- Check the appropriate box to indicate your entity designation. If you are doing business under a different name, please provide that in the 'Business Name' field.

- Fill out the 'Order-From Address' section with the address where orders should be mailed. This field is also required.

- If the address where payments are mailed is different from the order-from address, complete the 'Remit-To Address' section.

- Provide your taxpayer identification number (TIN) in the designated box as required. Ensure that it matches the legal name provided to avoid backup withholding.

- Complete the exemption section if applicable. Enter any exemption codes that apply to you if you are exempt from backup withholding.

- Review the certification statement carefully. Ensure you meet all criteria and check the box to certify your information is accurate.

- Fill in your printed name, title, phone number, and date in the respective fields.

- Sign the form in the 'Signature of U.S. Person' section.

- If you wish to set up direct deposit, provide your bank account number, name on the bank account, routing number, and select the type of deposit.

- Lastly, save your changes, and utilize the options to download, print, or share the form as needed.

Complete your forms online to simplify the document management process!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, you need to fill out your W9 form yourself, providing accurate information about your name, business name (if applicable), and taxpayer identification number. Keeping your information accurate helps to avoid issues with tax reporting. Using platforms like UsLegalForms can simplify this process under the SD BFM-0001 umbrella.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.