Loading

Get Sc St-389 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC ST-389 online

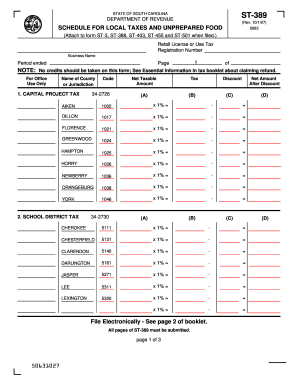

The SC ST-389 form is essential for reporting local taxes and unprepared food sales in South Carolina. This guide aims to provide clear and comprehensive instructions for users to complete the form accurately and efficiently online.

Follow the steps to fill out the SC ST-389 form online.

- Click the ‘Get Form’ button to access the SC ST-389 form and open it in your preferred editor.

- Enter the required information in the header section, including your retail license or use tax registration number, business name, and the period ended for the reporting.

- In the 'Name of County or Jurisdiction' field, specify the relevant county where your business operates.

- For each tax category such as Capital Project Tax, School District Tax, Transportation Tax, and Catawba Tribal Tax, input the net taxable amount, and calculate the tax by using the appropriate code provided on the form.

- Ensure to record the discount (if any) and compute the net amount after discount for each tax line.

- Complete the worksheet section, providing details on net sales and purchases as instructed. Ensure all totals agree with the final calculations.

- Add any allowable deductions as instructed in the form, ensuring accuracy in each entry.

- Once you have filled in all necessary sections, review the form for completeness and accuracy.

- Upon finishing the form, you will have options to save changes, download the document, print it, or share it for further processing.

Complete your SC ST-389 form online today and ensure all your local tax obligations are met efficiently.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Absolutely, you can file your South Carolina taxes online, making the process simpler and more efficient. Many taxpayers prefer this method due to its convenience and the ability to track submissions as per SC ST-389 guidelines. Online platforms often provide step-by-step instructions to ease any confusion. For a smooth experience, consider using resources from uslegalforms.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.