Loading

Get Sc St-389 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC ST-389 online

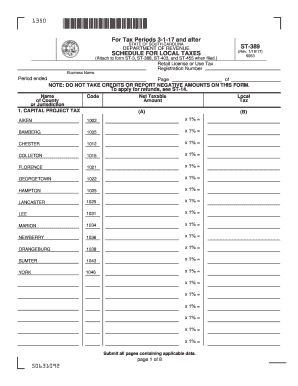

This guide will assist you in completing the SC ST-389 form for reporting local taxes effectively. The instructions provided here are clear and user-friendly, aimed at helping all users, regardless of their previous experience with such forms.

Follow the steps to fill out the SC ST-389 online

- Press the ‘Get Form’ button to acquire the SC ST-389 form and access it in your preferred digital environment.

- Fill in the Retail License or Use Tax Registration Number and the Business Name at the top of the form. Ensure that the information matches your official records.

- Specify the relevant Tax Period at the next section where indicated. Make note of the period you are reporting for, as it is critical for accurate tax filing.

- Begin itemizing local taxes. For each county or jurisdiction where business activities occurred, enter the Net Taxable Amount next to the corresponding Local Tax. Use the provided numerical codes for precision.

- Complete the Local Tax Allowable Deductions by entering types of deductions in Column A and their corresponding amounts in Column B. This will adjust your net taxable amount.

- Calculate the total amount of deductions and enter this in Item 3. This total will be critical for understanding your net sales and purchases.

- Determine the Net Sales and Purchases by subtracting the Total Amount of Deductions from the Gross Proceeds of Sales. Enter this final figure in Item 4.

- Once all sections are filled out completely, review the entire form for accuracy. When satisfied with your input, save your changes and prepare for submission.

- You can then download, print, or share the form as needed, ensuring that you keep a copy for your records.

Get started on filling out your SC ST-389 online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The ST-3 form in New Jersey is used by purchasers to claim an exemption from sales tax on specific purchases. This form helps both buyers and sellers comply with state tax laws. While it's not directly related to SC ST-389, understanding such forms is vital for tax management both in New Jersey and South Carolina. For a clear explanation of related forms, US Legal Forms provides accessible resources.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.