Get Sc Pt-441 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC PT-441 online

Filling out the SC PT-441 is an essential task for motor carriers in South Carolina to ensure proper property tax reporting. This guide provides a clear and supportive outline for successfully completing this form online.

Follow the steps to accurately complete the SC PT-441 online.

- Press ‘Get Form’ button to access the SC PT-441 form and open it within your preferred editor.

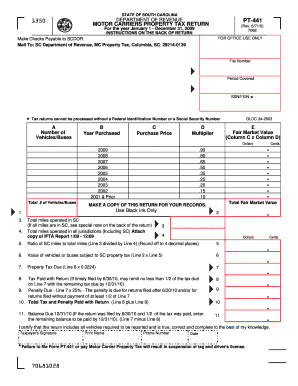

- Begin by providing your file number and the period covered, ensuring that you include the correct Federal Identification Number or Social Security Number as required.

- In Column A, list the total number of vehicles or buses owned as of December 31, 2009, categorized by the year of purchase in Column B.

- Enter the purchase price of each vehicle in Column C, making sure to include only the original costs, excluding any additional fees.

- Input the corresponding multiplier in Column D, which represents the taxable percentage of the purchase price after depreciation.

- Calculate the fair market value for each vehicle by multiplying the values from Column C by those in Column D, and enter the results in Column E.

- Add up the total number of vehicles in Column A and enter this total on Line 1.

- Calculate the total fair market value from Column E and record this on Line 2.

- If applicable, enter the total miles operated in South Carolina on Line 3 and the total miles operated in all jurisdictions on Line 4.

- Calculate the ratio of South Carolina miles to total miles and record this value on Line 5, rounding to four decimal places.

- Determine the value of vehicles subject to South Carolina property tax and enter this on Line 6.

- Calculate the property tax due by multiplying the amount on Line 6 by 0.0224, entering this on Line 7.

- If filing on time, indicate any tax paid with the return on Line 8.

- If applicable, calculate and enter any penalty due on Line 9.

- Complete the total tax and penalty amounts on Line 10.

- If the return was filed timely, indicate any remaining balance due on Line 11.

- Finally, review the entire form for accuracy, sign it, and then save your changes. You can download, print, or share the completed form as needed.

Complete your documents online to ensure compliance and avoid penalties.

Get form

Related links form

The property tax on a personal vehicle in South Carolina is determined using the fair market value for your vehicle, as computed on the SC PT-441 form. Tax rates can vary, reflecting local government's tax policies, which might significantly influence the final amount. By being proactive and completing the SC PT-441, you can ensure you're paying a fair tax based on your vehicle's worth. It's a smart way to stay on top of your financial responsibilities.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.