Loading

Get Sc Pt-441 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC PT-441 online

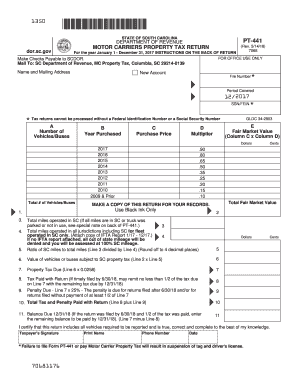

The SC PT-441 is a vital document for motor carriers in South Carolina to report property tax on their vehicles. This guide provides clear, step-by-step instructions for filling out this form online, ensuring accuracy and compliance with state regulations.

Follow the steps to successfully complete the SC PT-441 online

- Click the ‘Get Form’ button to acquire the SC PT-441 form and open it in your preferred online editor.

- Begin by entering your name and mailing address in the designated fields at the top of the form. Ensure that the information is accurate and clearly printed without the use of abbreviations.

- Fill in the period covered by the tax return. For this form, enter '12/2017'.

- Enter your Social Security Number (SSN) or Federal Employer Identification Number (FEIN) in the designated field. Remember, the return cannot be processed without this information.

- In Column B, list the year each vehicle was purchased, corresponding to the vehicles listed in Column A.

- Complete Column D by entering the correct multiplier for depreciation applicable to each vehicle.

- Total the number of vehicles in Column A and the fair market values in Column E, entering those totals in Lines 1 and 2 respectively.

- If all miles traveled were in South Carolina, or the vehicle was parked, skip to Line 6. Otherwise, report total miles operated in South Carolina and in all jurisdictions in Lines 3 and 4.

- Calculate the ratio of South Carolina miles to total miles from Lines 3 and 4, rounding to four decimal places, and enter it in Line 5.

- Compute the value subject to South Carolina property tax in Line 6, followed by calculating the property tax due in Line 7.

- If filing by the due date, you may opt to remit only half the tax due in Line 8, with the balance due by December 31, 2018.

- Finalize by totaling all payments in Line 10 and determining any balance due in Line 11, if applicable.

- Once all fields are completed, you can save changes, download, print, or share the form as needed.

Complete your SC PT-441 form online today to ensure compliance with property tax regulations.

To amend a tax return that you already filed, you need to complete the appropriate amendment form for your state. In South Carolina, this is the SC1040X. Utilizing resources such as the SC PT-441 can help guide you through the amendment process effectively. Consider checking uslegalforms for guidance on filling out the necessary forms correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.