Loading

Get Sc Pt-300a 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC PT-300A online

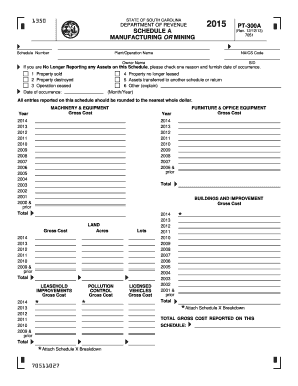

Filling out the SC PT-300A form is essential for accurately reporting your manufacturing or mining assets in South Carolina. This guide provides a clear, step-by-step approach to help you complete the form online with ease.

Follow the steps to fill out the SC PT-300A form successfully.

- Press the ‘Get Form’ button to access the SC PT-300A document and open it in your online editor.

- Begin by entering the plant or operation name in the designated field, followed by the NAICS code and owner's name. Ensure all information is correct and up-to-date.

- In the next section, indicate if you are no longer reporting any assets on this schedule. Select the appropriate reason from the provided options and enter the date of occurrence in the specified format (Month/Year).

- Proceed to the various sections to report your assets. For each type of asset—machinery and equipment, furniture and office equipment, buildings and improvements, land, leasehold improvements, pollution control, and licensed vehicles—input the gross cost for each year and calculate the total for each category.

- Ensure that all entries reported are rounded to the nearest whole dollar. Carefully review each entry to avoid any errors.

- If required, attach the Schedule X breakdown, as indicated on the form, to provide additional details about the reported assets.

- Once you have completed all sections of the form, save your changes. You can then download, print, or share the completed form as needed.

Complete your SC PT-300A form online today to ensure accurate and timely reporting of your assets.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Seniors in South Carolina do not entirely stop paying property taxes at a specific age, but they may benefit from certain exemptions starting at 65. These exemptions can significantly lower the property tax burden for eligible seniors. It's important to investigate how SC PT-300A can aid in understanding these exemptions. Consulting with a tax professional can provide clarity on the process and eligibility.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.