Get Sc Pr-26 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC PR-26 online

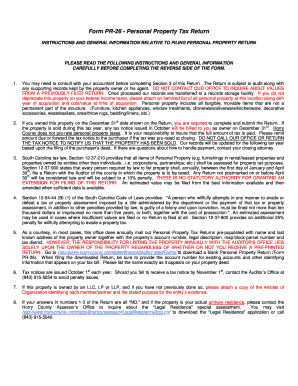

The SC PR-26 is a crucial form for reporting personal property taxes in Horry County, South Carolina. This guide provides you with the necessary steps to accurately complete the form online, ensuring compliance with local tax laws.

Follow the steps to fill out the SC PR-26 online effectively.

- Press the ‘Get Form’ button to access the SC PR-26 form and open it in your preferred online editor.

- Fill in your name and mailing address at the top of the form. Ensure that the name matches what is on your property deed.

- Enter your account number, property description, location, real estate map-block-parcel number, and tax district information.

- Check if you are filing an amended return by marking the checkbox provided.

- In Section 1, specify whether the property is residential, providing details if it is available for rent or lease.

- Complete Section 2 for businesses, detailing your type of business activity, dates, and any names under which the personal property may have been filed previously.

- Answer the questions in Sections 1 and 2 honestly and accurately, indicating whether the property has been sold and if it is depreciated on your tax return.

- Proceed to Section 3 if your answers indicate active business usage. Attach your most recent federal depreciation schedule or an itemized list of personal property as required.

- In Section 4, certify the accuracy of your information with your signature, printed name, date, and contact information. Ensure everything is completed to avoid penalties.

- Once all sections are completed, save changes to your form, and prepare it for submission. You can choose to download, print, or share the completed form as needed.

Complete your SC PR-26 online today to ensure your personal property taxes are filed accurately and timely.

Get form

Applying for a property tax exemption in South Carolina involves completing an application form available from your local assessor's office. You should provide necessary documentation that proves your eligibility, such as identification and residency proof. Utilizing platforms like uslegalforms will guide you through the application, particularly concerning the SC PR-26 criteria, to help you secure the exemption you need.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.