Loading

Get Sc Dor Wh-1612 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR WH-1612 online

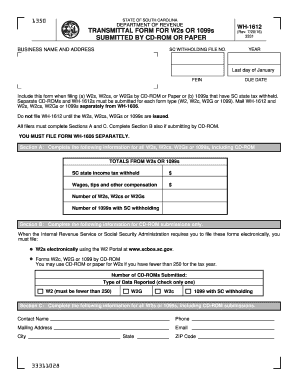

Filling out the SC DoR WH-1612 form online is essential for reporting W2s and 1099s with South Carolina withholding. This guide will provide you with step-by-step instructions to accurately complete the form.

Follow the steps to fill out the SC DoR WH-1612 form correctly.

- Click the ‘Get Form’ button to access the WH-1612 online form and open it for editing.

- In Section A, provide the total South Carolina state income tax withheld, the total wages, tips, and other compensation, and the respective number of W2s, W2cs, or W2Gs submitted. Also, indicate the number of 1099s with SC withholding.

- If you are submitting via CD-ROM, complete Section B by stating the number of CD-ROMs submitted and checking the appropriate box to indicate the type of data reported: W2, W2G, W2c, or 1099 with SC withholding.

- In Section C, fill in your contact information, including your name, phone number, mailing address, email, city, state, and ZIP code.

- Review all the information you have entered to ensure accuracy and completeness. Make sure that you have all required sections filled out.

- Once you have verified that the form is complete, you can proceed to save changes, download a copy of the form, or print it for submission. Sharing the form may also be necessary depending on your filing process.

Complete your documents online efficiently and ensure timely submission!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Typically, the percentage of state tax withheld ranges based on your earnings and tax filings. For South Carolina, using the SC DoR WH-1612 can guide you in determining the correct withholding percentage, enabling you to see how much should be set aside for state taxes. Always account for adjustments based on changes in income or claimed deductions.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.