Loading

Get Sc Dor Wh-1606 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the SC DoR WH-1606 online

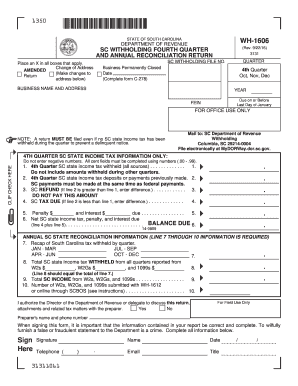

The SC DoR WH-1606 form is essential for the reconciliation of South Carolina state withholding for the fourth quarter and annual filings. This guide will walk you through each section of the form to ensure accurate and complete submission online.

Follow the steps to complete your SC DoR WH-1606 online.

- Click ‘Get Form’ button to access the SC DoR WH-1606 form and open it in the editor.

- Complete the top section of the form by entering the business name and address, the SC withholding file number, the Federal Employer Identification Number (FEIN), and the year for which you are filing.

- Indicate whether this is an amended return by placing an X in the appropriate box if applicable. Also, check the box for a change of address if needed.

- In the '4th Quarter SC state income tax information only' section, fill in the amounts for the following lines: 1) total SC state income tax withheld during the fourth quarter, 2) total SC income tax deposits or payments made previously, 3) SC refund if applicable, and 4) SC tax due if applicable.

- For lines 5 and 6, enter any penalties and interest that are due and calculate the net SC state income tax you owe.

- Proceed to the 'Annual SC state reconciliation information' section and complete lines 7 through 10. This includes providing a recap of South Carolina tax withheld by quarter and totals from W2s, W2Gs, and 1099s.

- At the bottom of the form, authorize the release of confidential information if desired by checking the 'Yes' box, and provide the preparer's name and phone number.

- Sign the document where indicated, including your name, telephone number, date, email, and title.

- Once all fields are completed, save your changes, and prepare to submit your form electronically. Remember to not mail the form if filing online.

Complete your SC DoR WH-1606 online today for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To obtain a SC sales tax ID number, register your business with the South Carolina Department of Revenue. This number is crucial for businesses that collect sales taxes. You can complete the registration online, ensuring a streamlined process. If you need detailed instructions or forms, the US Legal Forms platform offers valuable resources.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.