Loading

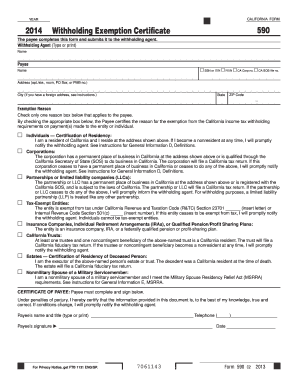

Get Ca Ftb 590 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 590 online

Filling out the CA FTB 590, the Withholding Exemption Certificate, online can streamline the process of certifying exemption from California income tax withholding. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to successfully complete the CA FTB 590 form online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editing software.

- Enter the withholding agent's name in the designated field. This is the person or entity responsible for withholding the tax.

- Fill in your personal identification details. Check the appropriate box for your taxpayer identification number (TIN), which can be your social security number (SSN), individual taxpayer identification number (ITIN), federal employer identification number (FEIN), California corporation number, or California Secretary of State (SOS) file number.

- Provide your address, including any apartment or suite numbers, city, state, and ZIP code. If you are using a foreign address, follow the specific instructions for foreign addresses.

- Select one exemption reason from the list provided. This signifies why you are exempt from withholding under the California income tax law. Ensure to read the descriptions carefully to select the correct option.

- Sign and date the form in the certification area. This is a declaration that the information you provided is accurate to the best of your knowledge and that you will notify the withholding agent if there are any changes in your status.

- Review all entered information for completeness and accuracy to prevent any delays or issues.

- Once satisfied with the information provided, save the changes to your file. You can then download, print the form for your records, or share it as required.

Complete your CA FTB 590 form online today to ensure your tax exemptions are processed without delay.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The CA 590 form serves to declare your claim for exemption from California withholding taxes. It allows individuals and entities to provide required information to validate their tax-exempt status. Utilizing the CA FTB 590 effectively can help prevent unnecessary withholding and ensure compliance with state regulations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.