Loading

Get Sc Dor Sc1120s 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC1120S online

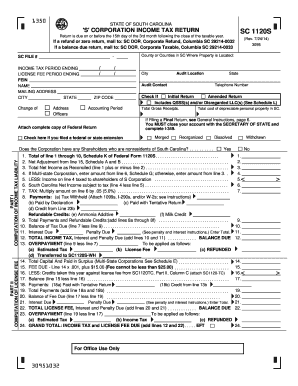

The SC DoR SC1120S form is essential for 'S' Corporations operating in South Carolina to report their income and taxes. This guide provides clear and detailed instructions to help users complete the form online effectively.

Follow the steps to fill out the SC DoR SC1120S form online.

- Click 'Get Form' button to begin and access the SC DoR SC1120S online form.

- Fill in the top section with your SC file number, income tax period ending date, license fee period ending date, FEIN, business name, and mailing address.

- Indicate if the form is an initial return, amended return, or includes Qualified Subchapter S Subsidiaries (QSSS) by marking the appropriate checkboxes.

- Complete Part I, which requires computation of income tax liability. Enter the total gross receipts and the total cost of depreciable personal property in South Carolina.

- Move to Part II, focusing on license fee computation. Calculate the fee due based on your business's capital and paid-in surplus as instructed.

- In Schedule A and B, provide details about any additions and deductions from federal taxable income as required.

- Complete all necessary sections applicable to your corporation, ensuring any additional schedules are attached as needed.

- Review all entries for accuracy, especially the totals and calculations in all parts of the form.

- Final step allows you to save your changes, download, print the form, or share it as needed.

Complete your SC DoR SC1120S form online today to ensure compliance and timely filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, you can file Form 1120 yourself, provided you have a clear understanding of your business's financial situation. However, the complexities involved may lead you to consider using professional services. The SC DoR SC1120S supports self-filing, but leveraging platforms like US Legal Forms can help streamline the process and minimize errors. They offer resources that guide you through each step of filing your taxes accurately.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.