Loading

Get Sc Dor Sc1120 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC1120 online

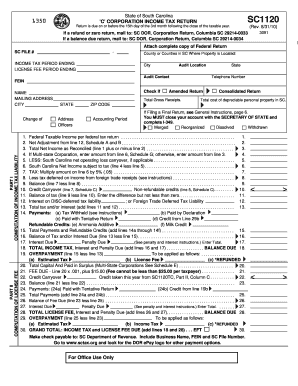

This guide provides a clear and comprehensive overview for users on how to complete the SC DoR SC1120 'C' Corporation income tax return online. It is designed to assist both experienced and novice users in accurately filling out this important tax document.

Follow the steps to complete the SC DoR SC1120 form online.

- Press the ‘Get Form’ button to access the SC1120 form, which will open in your editor for editing.

- Fill in the SC File Number and the Income Tax period ending in the designated fields at the top of the form.

- Complete the sections for your corporation's name, mailing address, city, state, and ZIP code.

- Provide the Federal Employer Identification Number (FEIN) and indicate if this is an amended return by checking the appropriate box.

- In Part I, compute the income tax liability by filling out total gross receipts, federal taxable income, and any applicable adjustments as outlined in the form's instructions.

- Complete Part II by calculating the license fee based on the total capital and paid-in surplus at the end of the year, as well as any necessary multipliers.

- Review all the calculations in the tax and fee sections to ensure accuracy before finalizing.

- Once all fields are filled out and confirmed for accuracy, save your changes to the form.

- Download or print the SC1120 form for your records, or share it with your tax preparer if needed.

Complete your SC DoR SC1120 form online today to ensure your corporation adheres to tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

On your W4 form, you generally do not claim yourself as an exemption because the purpose of the form is to calculate the correct tax withholding. Instead, you will focus on your total allowances based on your personal and financial situation. Carefully analyzing your eligibility will help you fill out the SC DoR SC1120 correctly and ensure accurate withholding.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.