Loading

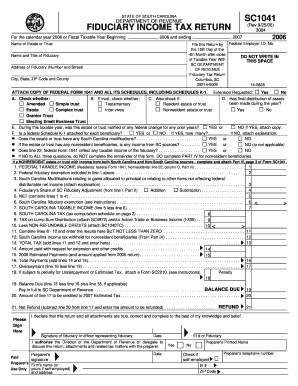

Get Sc Dor Sc1041 2006

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC1041 online

This guide provides clear, step-by-step instructions on how to fill out the SC DoR SC1041 form online. Designed for users with various levels of legal experience, the guide aims to make the process straightforward and accessible.

Follow the steps to seamlessly complete the SC DoR SC1041 online.

- Click ‘Get Form’ button to acquire the SC1041 and access it for completion.

- Begin by filling in the name of the estate or trust and the fiduciary's details, including the name, title, and address.

- Specify the Federal Employer Identification Number and ensure the return is filed by the 15th day of the 4th month after the close of the taxable year.

- In the 'Extension Requested' section, check the appropriate boxes if applicable, such as for a simple trust, complex trust, or if an extension is requested.

- Complete the income-related sections, including reporting federal taxable income from the Federal Form 1041 and entering any applicable exemptions.

- Address any adjustments related to South Carolina fiduciary income taxes, ensuring to compute the net income accurately.

- Attach a copy of the Federal Form 1041 and all necessary schedules, including Schedules K-1, as required.

- Once all sections are complete, review the form for accuracy, then save changes, download, print, or share the completed SC1041 as needed.

Complete your SC DoR SC1041 form online with ease today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Absolutely, a charitable remainder trust (CRT) is required to file Form 1041 to report its earnings. This form provides the IRS with a detailed record of income generated by the trust and any distributions made to beneficiaries. Filing the SC DoR SC1041 is necessary for the CRT to comply with tax laws. If you're navigating this process, our platform can assist you in filing correctly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.