Loading

Get Sc Dor Sc1040x 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC1040X online

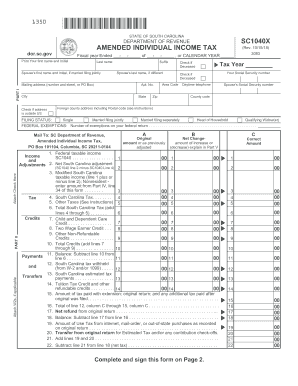

The SC DoR SC1040X form is essential for individuals looking to amend their state income tax returns in South Carolina. This guide offers clear and supportive step-by-step instructions to help users successfully complete the form online.

Follow the steps to fill out the SC DoR SC1040X form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the tax year for which you are amending your return in the designated space.

- Fill in your full name and social security number as they appear on your original return.

- If married and filing jointly, input your spouse's first name, initial, and social security number as well.

- Provide your current mailing address, including the county code and daytime telephone number.

- Check the appropriate box indicating your filing status — select from options such as single, married filing jointly, or head of household.

- Enter the number of exemptions claimed on your federal return, if applicable.

- Proceed to Part II to enter the amounts from your original return, along with any changes that you are making. Fill out Columns A, B, and C accordingly.

- Summarize your tax calculations by correctly entering total taxes and any applicable credits.

- Complete and sign the form on Page 2, ensuring both spouses sign if filing jointly.

- Save your changes, download the filled-out form, print it, or share it as needed.

Complete your SC DoR SC1040X form online today to ensure swift and accurate processing of your tax amendments.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

In South Carolina, taxpayers aged 65 and older can qualify for special income tax deductions designed to ease their financial burden. This can include an additional exemption that reduces their taxable income significantly. For a full overview of possible tax benefits related to age, especially when filing with the SC DoR SC1040X, consult the relevant state resources or a tax professional.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.