Loading

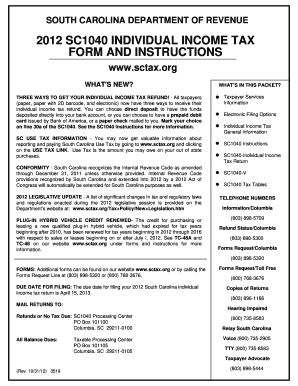

Get Sc Dor Sc1040 Instructions 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC1040 Instructions online

Filling out your South Carolina Individual Income Tax return can be daunting, but with the right guidance, the process can be straightforward. This guide will walk you through the SC DoR SC1040 Instructions step-by-step to ensure that you submit your tax return accurately and efficiently.

Follow the steps to fill out your SC DoR SC1040 Instructions online.

- Click the ‘Get Form’ button to access the SC1040 in your preferred editor.

- Review the instructions carefully to understand your filing status and exemptions required. Ensure the social security numbers listed are accurate.

- Fill in the name and address section, making sure to indicate if this is a new mailing address. Check the box if you are filing as a nonresident or part-year resident.

- Enter your federal taxable income from the related federal form. If your taxable income is zero or less, enter zero.

- Complete the additions to federal taxable income by following the provided details to arrive at your total additions. Make sure to include any state tax addbacks if necessary.

- Proceed to fill out the subtractions from federal taxable income, ensuring to include any relevant credits or deductions applicable to you.

- Calculate your total South Carolina taxable income by subtracting total subtractions from total additions and write this in the appropriate section.

- Determine the tax amount owed using the tax tables provided in the instructions and enter it on the designated line.

- If applicable, fill out the refund section, selecting your preferred method for receiving your refund, whether by direct deposit, debit card, or paper check.

- Review your entries for accuracy, sign the return if filing jointly, and save your changes before submitting. Ensure you keep a copy for your records.

Complete your SC DoR SC1040 Instructions online today for a seamless filing experience!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filling out a tax amendment involves completing Form 1040-X to correct previously filed tax returns. Be sure to include the corrected figures and a detailed explanation of the changes. The SC DoR SC1040 Instructions can guide you through this process and help ensure your amendments are filed correctly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.