Loading

Get Sc Dor Sc1040 2004

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC1040 online

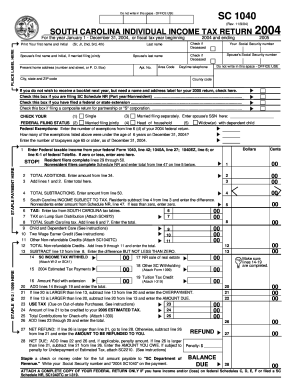

Filling out the SC DoR SC1040 form online can streamline your tax filing process and help ensure accuracy. This guide provides clear, step-by-step instructions to assist you in navigating each section of the form effectively.

Follow the steps to complete your SC DoR SC1040 online

- Press the ‘Get Form’ button to access the SC DoR SC1040 form and open it in the designated editor.

- Begin by entering your first name and initial, followed by your last name in the designated fields. If you are filing jointly, also add your spouse's first name and initial, along with their last name.

- Fill in your present home address, including the street address or P.O. Box, apartment number, city, state, and ZIP code. Remember to check the box if you are deceased.

- Enter your Social Security number and your spouse's Social Security number if applicable. If you are married filing separately, enter your spouse's SSN as prompted.

- Indicate your federal filing status by checking the corresponding box for single, married filing jointly, married filing separately, head of household, or widow(er) with dependent child.

- For federal exemptions, enter the number of exemptions claimed on your federal return and indicate how many of these were under age 6 as of December 31, 2004.

- Continue by entering your federal taxable income as indicated. In case you are a nonresident, complete Schedule NR and ensure to follow the guidance for residents and nonresidents appropriately.

- Carefully fill in the lines for total additions, subtractions, and South Carolina income subject to tax as per the instructions laid out in the form.

- Compute your total tax owing or refund by following the calculations for non-refundable credits and withholding amounts detailed in the form.

- Once all sections are complete, review the form for accuracy. Users can then save changes, download, print the completed form, or share it as needed.

Complete your tax documents online now for a convenient and efficient filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Filling out your 1040 form involves gathering your financial information, including income, deductions, and credits. Start with basic personal details and then categorize your income sources, ensuring to adhere to the guidelines established by the SC DoR SC1040. For a streamlined process, consider using dedicated tax preparation software or platforms like USLegalForms.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.