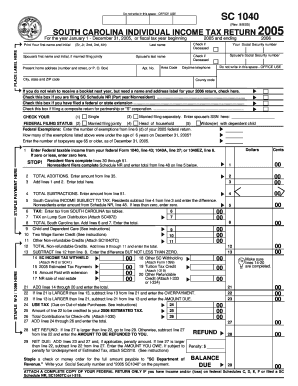

Get Sc Dor Sc1040 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign SC DoR SC1040 online

How to fill out and sign SC DoR SC1040 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Completing tax forms can become a significant issue and a major hassle if adequate support is not available. US Legal Forms is designed as an online resource for SC DoR SC1040 e-filing and provides numerous benefits for taxpayers.

Utilize the advice on how to complete the SC DoR SC1040:

Click the Done button in the upper menu once you have finished. Save, download, or export the completed template. Utilize US Legal Forms to ensure a comfortable and straightforward SC DoR SC1040 completion.

- Locate the template on the website in the designated section or by using the search feature.

- Click the orange button to access it and wait for it to load.

- Examine the template and follow the instructions. If you haven't filled out the form before, follow the step-by-step guidelines closely.

- Focus on the highlighted fields. These are editable and require specific information to be entered. If you're unsure what to input, refer to the instructions.

- Always sign the SC DoR SC1040. Use the integrated tool to create the e-signature.

- Select the date field to automatically populate the current date.

- Review the template to verify and modify it before submitting.

How to Alter Get SC DoR SC1040 2005: Personalize Forms Online

Explore a single service to manage all your documentation effortlessly. Locate, modify, and complete your Get SC DoR SC1040 2005 within a singular interface using intelligent tools.

The days when individuals had to print forms or even fill them out by hand are gone. Currently, all it takes to obtain and complete any form, such as Get SC DoR SC1040 2005, is opening just one web browser tab. Here, you will find the Get SC DoR SC1040 2005 form and tailor it in any way required, from typing directly into the document to sketching it on a digital sticky note and attaching it to the document. Uncover tools that will enhance your documentation without added effort.

Just click the Acquire form button to set up your Get SC DoR SC1040 2005 documentation effortlessly and start altering it right away. In the modification mode, you can readily fill in the template with your information for submission. Simply click on the field you wish to change and enter the data immediately. The editor's interface requires no particular skills to navigate. Once finished with the modifications, verify the information's correctness once more and sign the document. Click on the signature field and follow the directions to eSign the form in no time.

Utilize Additional tools to personalize your form:

Preparing Get SC DoR SC1040 2005 forms will never be confusing again if you know where to find the appropriate template and prepare it seamlessly. Do not hesitate to give it a try yourself.

- Employ Cross, Check, or Circle tools to highlight the document's data.

- Include textual information or fillable text boxes with text customization tools.

- Delete, Emphasize, or Obscure text sections in the document using corresponding tools.

- Incorporate a date, initials, or even a picture to the document if needed.

- Make use of the Sticky note tool to annotate the form.

- Use the Arrow and Line, or Draw tool to add visual components to your document.

Related links form

Anyone operating as a partnership, or a corporation in South Carolina must file the SC PT 100, ensuring proper documentation of their business's income and taxes owed. This requirement helps maintain transparency and adherence to state tax laws. Failing to file can lead to penalties and complicate your tax situation. For those navigating these regulations, the US Legal Forms platform offers comprehensive support and easy access to necessary forms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.